Entrepreneurs who desire to start a business in India, are often put in a quandary about the business structure they ought to adopt. Which is better for them if they register LLP or Pvt Ltd Company? Which business structure will bring them the maximum benefits while not burdening them with excessive legal requirements?

If you have been wondering about this issue, it will help to first understand the features of each business structure and then compare the two.

[Government of India has initiated the Start-up India Program to encourage entrepreneurs. To know more about this program, here is our article: “All about Start-up India Program launched by Government of India“]

What is a Private Limited Company

As the name suggests, a Private Limited Company is a business in which shareholders have ownership. A company is an independent legal entity which can own, buy and sell a property. It can also provide loans for business purposes. The private limited company’s legal existence does not depend on its members and is not affected by changes in its shareholders.

The shareholders, on the other hand, are responsible only for the shares they hold and are not held liable for any of the debts that the company might incur. A court of law cannot order their personal assets and seize for repaying company debts. The Memorandum of Association (MoA) and the Articles of Association (AoA) define the structure and object of the private limited company.

Looking Beyond Business Structure?Once your company is set up, the next big step is scaling globally. We help businesses simplify international trade with expert EXIM Consultancy, Documentation, Compliance, and International Logistics Solutions.

Get in Touch for One-Stop EXIM Solutions –

Features of a Private Limited Company

In India, a private limited company must adhere to the regulations determined by the Ministry of Corporate Affairs (MCA), the Companies Act of 2013 and the Companies Incorporation Rules of 2014.

To start a private limited company in India, you must have a minimum of two shareholders and a maximum of 200 shareholders. There is no minimum capital requirement for such a company, but it should have an authorized capital of at least Rs. 1 lakh, and you must pay all requisite professional fees. Fees may vary across different states. The cost for private limited company registration is Rs.7,999 and it takes up to 10 to 15 days for the incorporation process.

According to the MCA rules, a private limited company must undergo statutory audits and hold quarterly Board Meetings. It should record minutes of these meetings. The private limited company must also do annual filings with the RoC and annual submissions of IT returns.

The shareholders of a private limited company may operate the business themselves, or they may appoint a Board of Directors to lead the company for them.

If the private limited company’s shareholders want to transfer their shares to new owners, they must do so by signing and filing share transfer forms and share certificates. They may need to take permission of the other shareholders first. Many companies require this to prevent a hostile takeover.

A private limited company can raise equity funds from venture capitalists. They can also raise funds from the general public by issuing equity and preference shares only if the Articles of Association permits the company to do so. If the Reserve Bank of India permits it, they can also take deposits from investors.

In India, a private limited company must pay 30% taxes on profits. They must also pay the dividend distribution tax and the minimum alternate tax.

What is LLP Company

The simpler business structure and comparatively less legal compliance can explain the popularity of the Limited Liability Partnership business structure for Small and Medium-sized businesses in India. An LLP is a partnership that must have two partners at the minimum, and there is no limit on the maximum number of partners.

An LLP, like a private limited company, is an independent legal entity and can own property, incur debts and get sued. It is not affected by changes in its ownership. All the partners of an LLP are responsible only to the extent of their contribution and are not otherwise held liable for the LLP’s debts. An LLP uses the LLP agreement as its charter to denote its scope of operations and also the rights and duties of its partners.

Features of LLP

If you pick the LLP business structure, your business can enjoy some of the favorable features of both a private limited company and a partnership firm. For a business that doesn’t need to raise equity funds, it may make more sense to register with the MCA as an LLP. It is not necessary to have a paid-up capital to start an LLP, but you will need to pay around Rs. 5000 in registration fees to the MCA.

The MCA and the LLP Act of 2008, govern the registration of an LLP in India. For registration purposes, you will need a Digital Signature Certificate (DSC) and a Designated Partner Identification Number (DIN). Before registering, you must get the name approved from the RoC. As per MCA rules, you must include LLP as a suffix. The process can take up to 10 to 15 days.

[Digital Signature Certificate (DSC) validates your identity online and keeps information secure. To get in-depth knowledge about DSC, read our article: “What is a Digital Signature Certificate and How to get a DSC?“]

Unlike a private limited company, you don’t need to have an annual statutory meeting with an LLP. You also don’t need to get an annual audit done. By MCA rules, an audit is only necessary if an LLP has more than Rs. 25 lakhs in paid-up capital, or if it has an annual turnover that is greater than Rs. 40 lakhs.

There is a tax of 30% plus cess on the profits, but you get some tax benefits on profits exceeding one crore rupees. You won’t have to pay the tax surcharge that Pvt Ltd Companies with the same profits would have to. You are also exempted from dividend distribution tax, and any loans you give to partners will not be taxed as income. You must file the Statement of Accounts and Solvency, Annual Return and Tax Returns with the RoC every year.

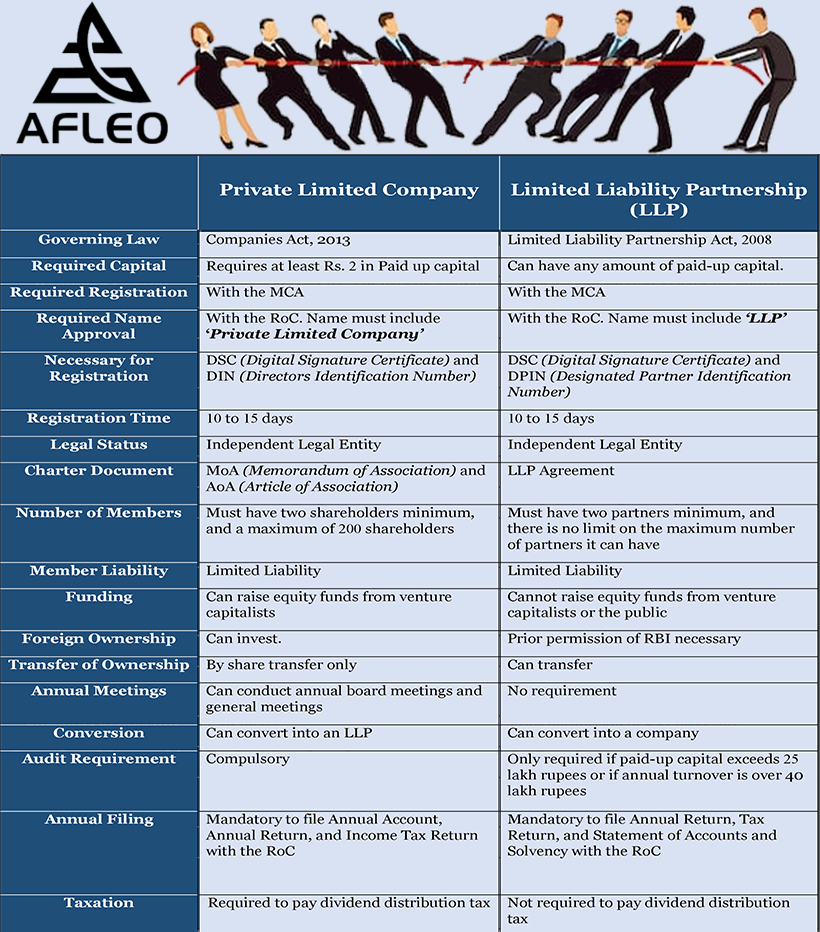

Difference Between LLP and Pvt Ltd Company

To decide which business structure will suit best to your purpose, take some time to consider your long-term business goals and check how these will work out with an LLP or Pvt Ltd Company.

[Hope you understand the difference between Pvt Ltd Company and LLP. To know more about how to register your own Company? Read our article on “How to Register Company in India? Complete Guide for a start-up“]

If you would like assistance in deciding which business structure to select and in registering your business as an LLP or a private limited company, please get in touch with us at Afleo.com. We have a young, efficient and knowledgeable team that can guide you through every step of the registration process. Within the shortest time possible, we will help you get your business up and running.

Starting a Product-Based Business or Planning to Export?Whether you choose LLP or Pvt Ltd, our digital freight platform simplifies international shipping-get transparent pricing, real-time tracking, and smooth documentation.