In India, as per the Companies Act 2013, it is mandatory to register a company with the Ministry of Corporate Affairs (MCA). The entire company registration process can be carried out online and, provided that the required forms have been correctly filled and all the necessary documents have been attached, the MCA will approve the application and send the Certificate of Registration within 10 days.

Before getting to the company registration process though, let us understand what a company is and how it differs from a LLP and a firm. There is often a confusion between the three, although, legally, they are quite separate entities.

[Want to know the benefits of Start-up India Programme? Here is the article “All about Startup India programme launched by the Government of India“]

What is a Company?

A company is a legal business entity that is established by one or more individuals to carry out profit-making, commercial transactions. There can be various types of companies, such as public limited companies, private limited companies, one person companies, and Section 8 companies. In India, the Companies Act 2013 requires the mandatory registration of all Indian companies, and the MCA regulates all the registered companies.

What is a Limited Liability Partnership (LLP)?

A LLP is a separate legal entity that can hold property and allows for perpetual succession; in brief, perpetual succession assures the continuation of the legal entity’s independent existence, regardless of changes in its ownership or in its members. A LLP can have two partners at the minimum and there is no upper limit for partners. There must be two Designated Partners (DPs) to oversee and assume liability of the LLC’s business, and at least one DP must reside in India for six months of the year. The other partners can generally conduct business for the LLP and have limited liability, which means they are each responsible only for themselves and not for the actions of the other partners. Individual partners can resign, but the LLP can be dissolved only by mutual agreement of all partners or by Court order.

[One of the outstanding features of the Limited Liability Partnership is that the partners enjoy separate identity apart from the firm. To know more about the various aspects of LLP in India click here. ]

What is a Firm?

A firm offers business and professional services and is generally established by one or more individuals, either as a partnership or as a sole proprietorship. In India, the Partnership Act 1932 allows for the registration of firms, but this is entirely voluntary and not legally mandatory.

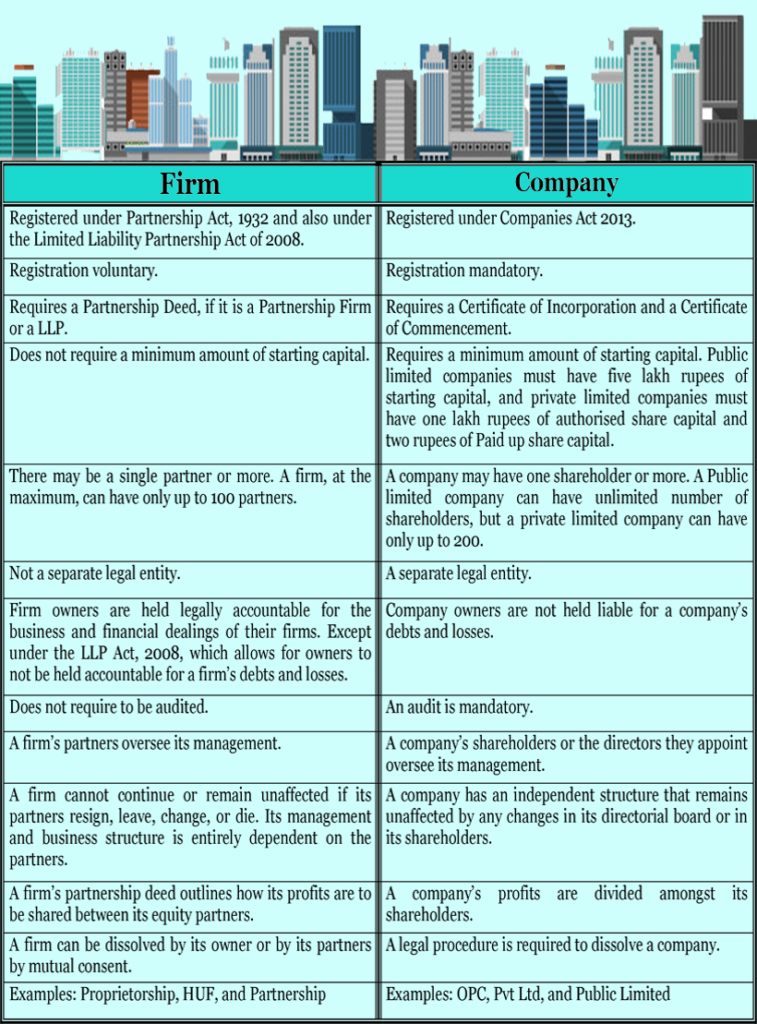

Difference between a Firm and a Company

The Importance of Registering a Company

- It is mandatory in India to register a company with the MCA.

- Registering a company in India offers legal protection for the company name, business, and structure. An incorporated company has an independent legal entity and it can exist regardless of any changes in its directors and shareholders.

- A registered company will be eligible for any governmental incentives and benefits that Indian companies routinely receive.

- Venture capitalists and private equities are more likely to regard registered companies as relatively risk-free for investment purposes.

- Since a registered company is an independent entity, its owners, directors, and shareholders are not held responsible for any financial losses it might incur.

- A registered company and its products or services may be perceived by consumers as reliable and authentic.

Types of Companies

There are various types of companies in India. Let us look at some of the main types:

Public Limited Company

A Public Limited Company is a company with an independent legal existence and whose shares are readily available for public purchase. It can have 7 shareholders minimum and no upper limit in the shareholders it can have. The company’s capital comes from the shares that shareholders buy, and the shares can be transferred without any need for notifying or getting prior consent from the company or the other shareholders. A board of directors manages the company and the shareholders cannot participate in the company’s management.

Private Limited Company

In a Private Limited Company, the shares are privately owned and the shareholders are only accountable for the shares they own. They cannot be held responsible for the company’s debts or financial losses. The shareholders may either manage the company on their own or hire directors to manage it for them.

[Confused between Public and Private Ltd Company? Here is our article on “Difference between Private Limited & Public Limited Company“]

One Person Company (OPC)

The Companies Act 2013 defines a One Person Company as a company with just one member. Except for this aspect, its provisions are the same as that of a private limited company. Only resident Indian citizens can incorporate a one person company in India, and one person cannot form more than 1 one person companies. An OPC is a separate legal entity and the shareholder is responsible only for unpaid subscription money. The single member nominates his or her successor.

Section 8 Company

Section 8 companies are companies that are involved in social, cultural, charitable, and research non-profit works. A Section 8 company does not pay dividends to its shareholders and its profits are generally ploughed back into the company. It can alter its MoA and AoA only with Central Government approval. A Section 8 company can only merge with another section 8 company that has the same objectives.

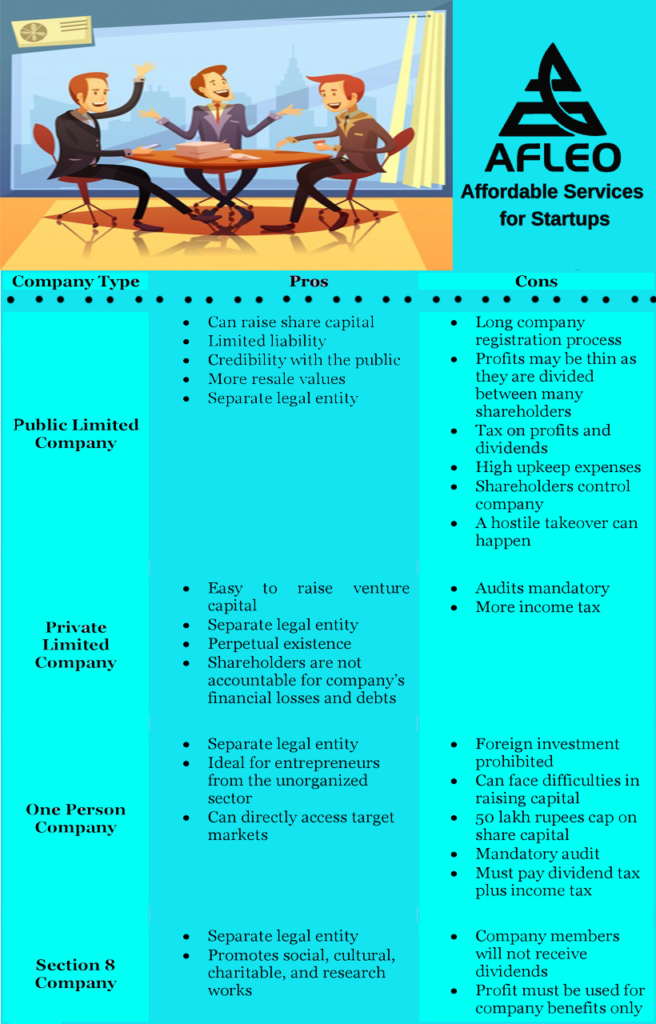

How to Pick the Right Company Option?

Picking the right company option depends on the business type and business goals, current, and future, as well as management and financial considerations. A One Person Company, for instance, offers management flexibility as it does not have to hold general or extraordinary general meetings. A private limited company is generally able to raise a good amount of venture capital as it is considered risk-free and reliable. A public limited company, by its very nature, can be at risk of a hostile takeover. To pick the right company option, it is necessary to check the pros of each company type as well as the cons and go with what best suits a particular business. A company’s long-term health and growth depends entirely on its business structure, so selecting the right one is of paramount importance.

[Every entrepreneur is constantly looking for financial assistance. As an aid to such entrepreneurs, Indian Government has launched Mudra Loan Scheme. To benefit from this scheme refer our article How to get Pradhan Mantri Mudra Yojana (PMMY) Loan?]

Pros and Cons of Each Type of Company

Procedure of Company Registration in India

Before a company can be registered in India, it requires to obtain the following:

Digital Signature Certificate (DSC)

According to the Information Technology Act, 2000, a DSC by an authorized person is needed to authenticate electronically filed legal documents.

The Controller of Certification Agencies appoints and authorizes eight Certificate Agencies to issue the DSCs. The MCA website has a list of the approved Certificate Agencies. According to the MCA’s stipulation, it is necessary to have a Class-II DSC or one in an upper category for efiling under MCA 21. The issued DSC is valid for one to two years and can be renewed on expiry. A person with a DSC can use it for all applications.

To obtain a DSC, the applicants must contact the Certificate Agency with the necessary supporting documents. The cost of issuing a DSC varies according to the issuing Certificate Agency.

Director Identification Number (DIN)

The Companies (Amendment) Act 2006 made it mandatory for all existing and prospective company directors to obtain a DIN from the MCA, except in the case of foreign directors of foreign companies, who aren’t required to get a DIN. The directors must first register on the MCA21 portal and upload the required forms there once they have completed them.

To obtain a DIN, a first-time director of a new company must fill out eForm SPICe and attach identity proof and residence proof along with it.

A prospective director of an existing company must fill out eForm DIR-3, get it digitally signed by the company’s full-time company secretary, CFO, CEO, managing director, or director, and include with it a passport-sized photograph, identity proof, residence proof, a DSC, and a DIN of an existing director or a PAN of the company’s CEO, CRO, or company secretary.

If a current director of an existing company, who already has a DIN, has to make any changes in his or her DIN particulars, he or she must fill out eForm DIR-6. The form particulars must be verified by a full-time chartered accountant, a full-time cost accountant, the company’s full-time company secretary, or the company director.

In all cases, payment must be made online via net banking, credit card, debit card, or NEFT.

The MCA will review the applications and if all the details and documents are correct and there is no duplicate information, they will generate a provisional DIN.

[Read our article on “Difference between PAN, TAN, TIN and DIN” to know more about the various important terms that one should know in the business world.]

Company Registration Process

Name Approval

To begin with, register with the MCA portal and get the company name approved by the Registrar of Companies (RoC) in the state or union territory where the company is going to be based. A private company must have ‘Private LTD’ at the end of its name and a public company must have ‘Limited’ at the end of its name. A Section 8 company cannot have either ‘Section 8’ or ‘Limited’ in its name. The RoC will approve the name within two days. An approved name is valid for 20 days and the rest of the company registration applications must be made within this period, or it will be necessary to apply anew for name approval.

Memorandum of Association and Articles of Association (MoA and AoA)

The Company’s Memorandum of Association (MoA) is the company’s constitution, containing the company’s objectives, work scope, and duties. The Articles of Association (AoA) contain the company’s rules and regulations for its internal management. The MoA and the AoA must be submitted to the RoC right after the company’s name has been approved. Form SPICe MoA and Form SPICe AoA are filed for this purpose.

File Forms

Both an Indian company as well a foreign company can register electronically with the RoC on the MCA portal. An Indian company can be registered by filing Form SPICe with PAN and TAN applications included in it, or by filing Form URC-1. Attach copies of the MoA and the AoA and other supporting documents to the forms, and by paying the prescribed fee. The RoC will check the application and issue a Certificate of Incorporation. A private company and a one person company can start its operation at once. A public company must wait until the RoC issues it a Certificate of Commencement of Business.

A foreign company will need to file Form FC-1 and will require a DSC of its authorized representative. Its directors aren’t required to obtain DINs.

If you wish to know more about registering your company in India, or if you would like assistance with getting your company registered, please click here or fill below form to get in touch and get your queries solved.