Export Promotion Capital Goods Scheme (EPCG Scheme) was introduced to allow duty-free import of capital goods/machinery including spares for pre-production, production, and post-production of export goods. Under the EPCG Scheme license is issued to Manufacturer exporter, Merchant exporter tied to supporting manufacturer and service providers.

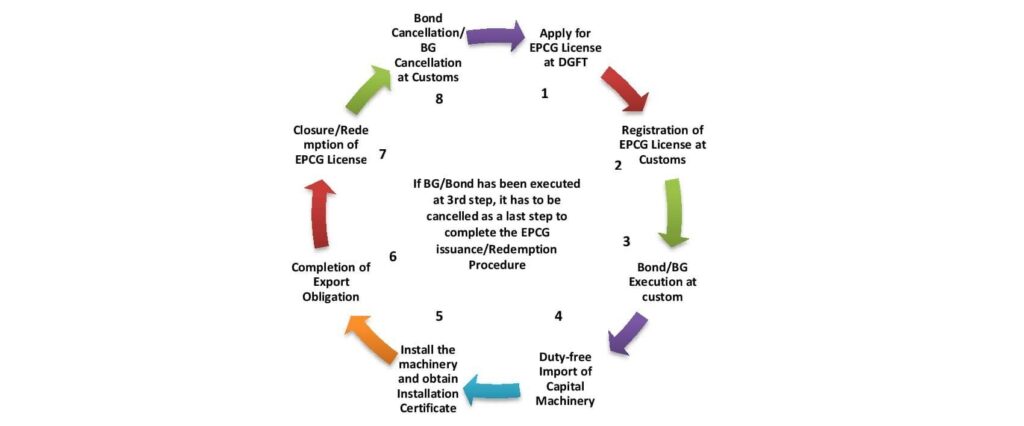

There are various steps involved under EPCG Scheme starting from license issuance at DGFT to license redemption at DGFT and Customs, In this article, we are going to discuss such an important step for the redemption of license that is Bank Guarantee(BG) and Bond Cancellation of EPCG License at Customs.

[Before knowing about BG/Bond cancellation if you are curious about each and every step involved in issuance and redemption of EPCG License in detail click on – “EPCG License Procedure | How to Obtain & Close an EPCG License – Ultimate Guide”]

What is BG/Bond Cancellation under EPCG and Why it is important?

The License is issued under EPCG with conditions to fulfill the export obligation (EO) equal to six times of duty saved value in 6 years.

While the import of capital goods is made at Customs, the license holder has to execute BG/Bond with customs specifying the liability of duty saved amount. The bond specifies the export obligation (EO) fulfillment period and other conditions. It also states that non-fulfillment of EO will lead to the recovery of duty saved amount plus applicable interest.

The BG/Bond has to be executed at the Port to clear the duty-free capital goods/machinery from customs and it will remain active until the cancellation process is not done with customs after License redemption at DGFT.

Therefore if the EO is completed it is also necessary to intimate the customs authority about the same and cancel the bond/B.G.

The BG/Bond cancellation is done at customs after submitting the Redemption Letter/Export Obligation Discharge Certificate (EODC) issued by DGFT and other required documents given as below.

Documents required for BG/Bond Cancellation at Customs

Documents List For cancellation of Bond/BG submitted against EPCG Authorizations:

- Original EODC/Redemption Letter.

- ANF 5B duly certified by Chartered Accountant.

- Copy of Installation Certificate issued by Chartered Engineer/Central Excise/GST authorities.

- Original EPCG Licence.

- Copy of S/Bs (ARE-1 in case deemed exports).

- Bank Realization Certificate [e-BRCs]

- In the case of third-party export (documents as per FTP 2015-20).

- Other relevant documents which were submitted to DGFT.

EPCG Bank Guarantee/Bond Cancellation Procedure at Customs

- Complete the Export Obligation in the given time period as mentioned in EPCG License.

- Get the EODC (Export Obligation Discharge Certificate)/Redemption Letter from the DGFT office after submitting relevant documents.

- The required documents to prove the EO completion is filed to the customs office where the BG/Bond execution has been performed.

- Documents verification is done in customs by the officers.

- If the Customs officers are satisfied with the obligation on bond and bank guarantee as per submitted documents, then they cancel the BG/Bond and do the necessary entry for the record in their system regarding fulfillment of EO.

- License holders get the canceled BG/Bond and also receive a letter from Customs regarding BG/Bond cancellation.

- Upon receiving the letter for cancellation, the Final Redemption would be considered under EPCG License.

- The said Bank guarantee can be surrendered to the bank.

- Bank will credit the bank guarantee margin amount which was kept while issuing the bank guarantee

How Afleo can help you in BG/Bond Cancellation??

We at Afleo Consultants are India’s leading Export Import Consultants, having rich experience of 10+ Years in the domain. We specialize in all the DGFT related matters, Export promotion schemes such as RoDTEP, MEIS, SEIS, Advance License, EPCG, DFIA, AEO certification, Star Export House certification, Duty Drawback, IGST Refund, etc.

Afleo Consultant is a recognized EPCG Consultant and a pioneer in the field of DGFT and handled numerous EPCG applications and helped our clients to successfully close the licenses at DGFT as well as Customs.

Our experts assist you in the issuance and redemption of the EPCG license at DGFT with the following BG/Bond cancellation tasks at Customs –

- We assist you to get the EODC from DGFT.

- We help you in preparing documents for BG/Bond Cancellation under EPCG.

- Submit the required Documents in customs for Cancellation.

- Attend Personal hearing in customs on behalf of the client.

- Follow-up with custom until the BG/Bond is canceled.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

We have a PAN India presence.

We would appreciate your comments and views on the above topic.