Introduction of AEO (Authorized Economic Operator) Certification

AEO is the status certification initiated by the World Customs Organization to secure and facilitate international trade under the SAFE framework of standards. The business entities having the AEO certification are considered safe and secure trading partners. There are three tiers of AEO certification for importers and exporters – AEO T1, AEO T2, and AEO T3 and single-tier AEO LO for logistics providers. To get the AEO Certificate, an online application has to be done on AEO Portal.

Introduction of Status Holder/ Star Export House Certification

The Status House Certificate/ Star Export House was introduced by the Government of India to boost the export performance of the country. The status certificate is granted to an exporter depending on his/her export performance.

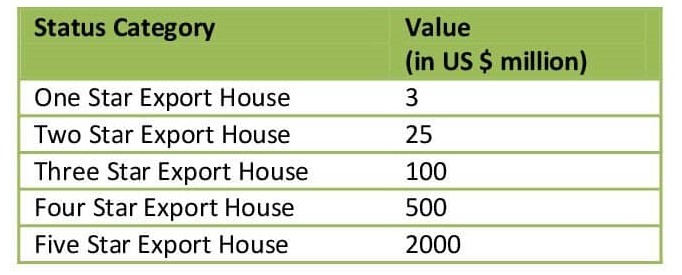

The applicant can get status holder recognition in any of the five categories from One Star Export House to Five Star Export House. Your export performance FOB/FOR value for them should be $3 million, $25 million, $100 million, $500 million, and $2000 million, respectively.

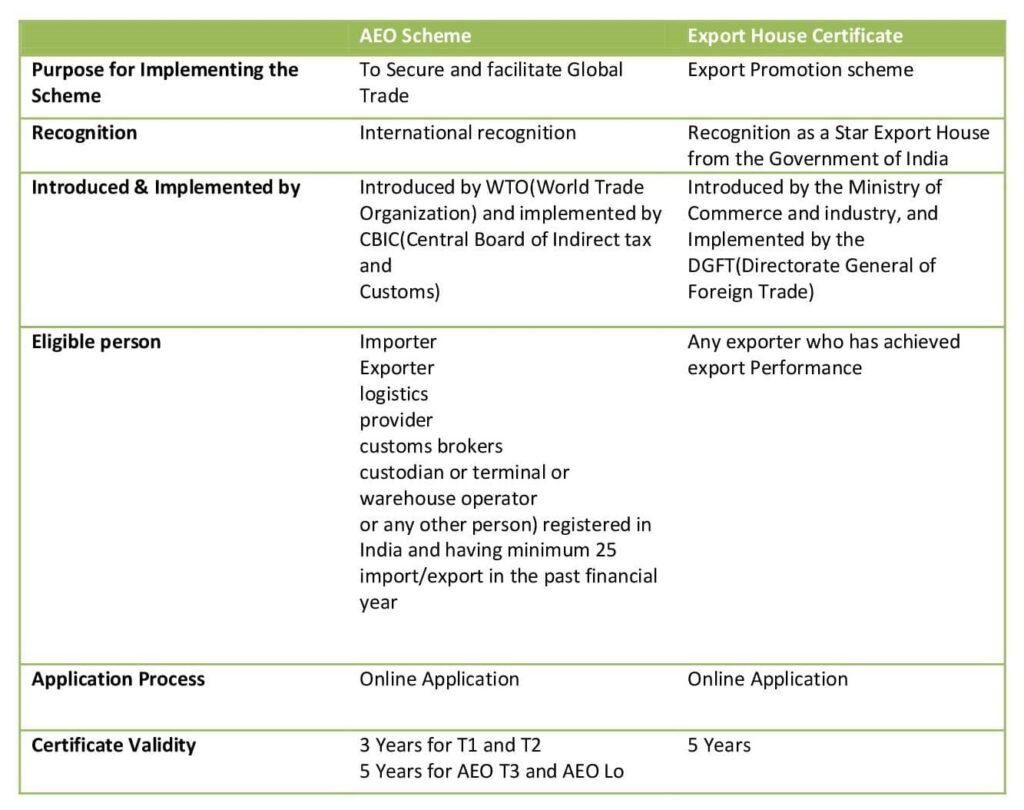

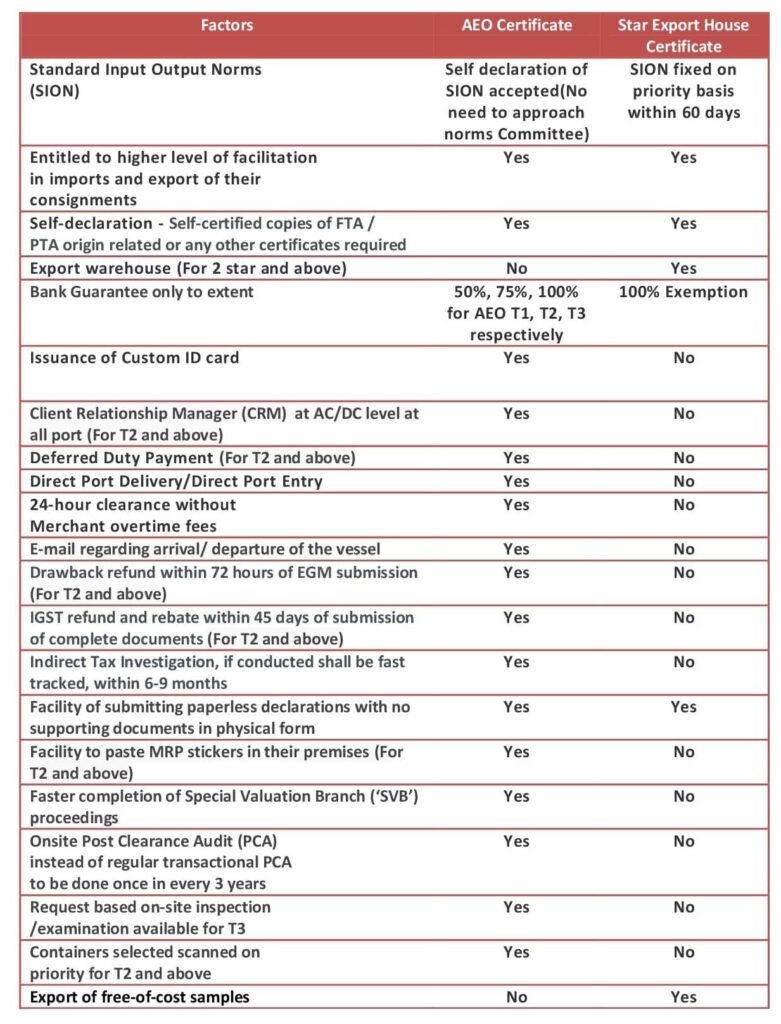

The benefits of Authorized Economic Operator (AEO) and Star Export House may appear similar to the importers and exporters but there are many differentiating factors between both the certification, with few similarities. In this article, we are going to discuss the similarities and differentiation in the benefits of both the certification which would help in understanding which certificate we should apply to get the maximum benefits or both the quality certification will add value to the company. (Refer the table below which explain the basic difference between both the certification).

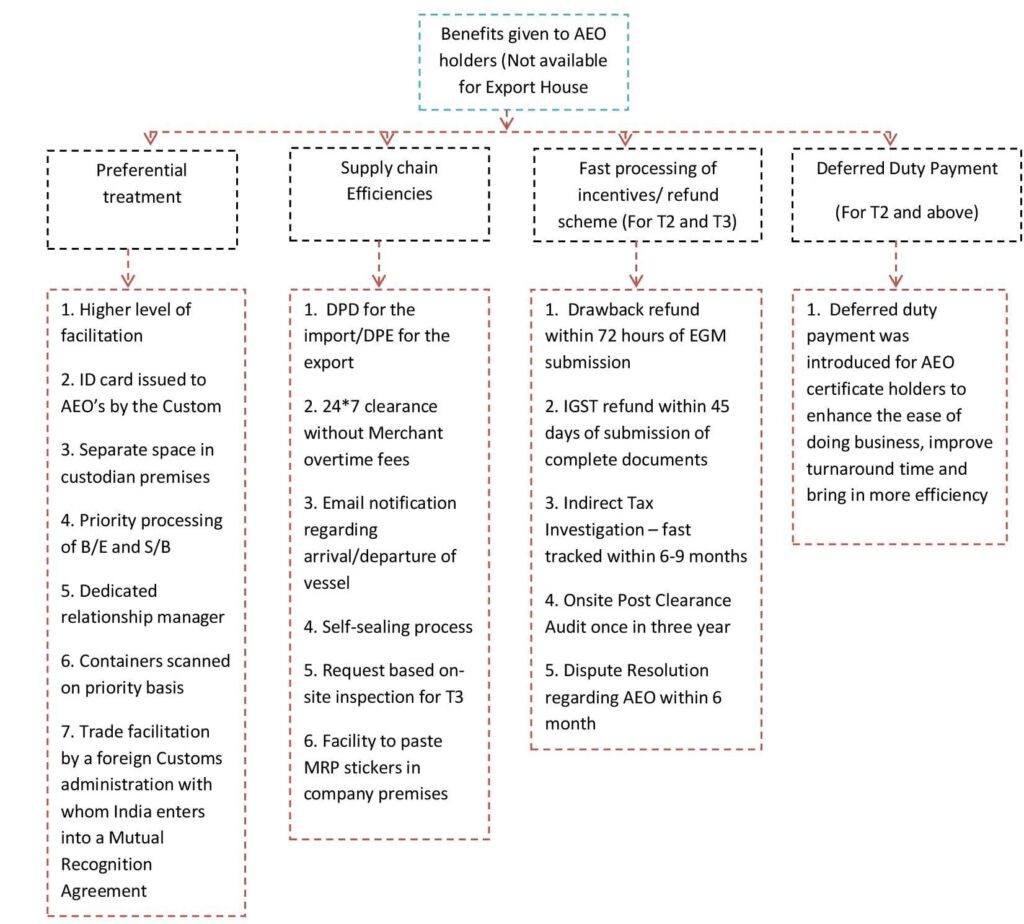

Set of benefits of AEO which are not available for Star Export House Holders

The benefits discussed below are only given under AEO certification and not provided by the Status holder Certificate, We will discuss each one by one.

- Direct Port Delivery (DPD) – For the Import

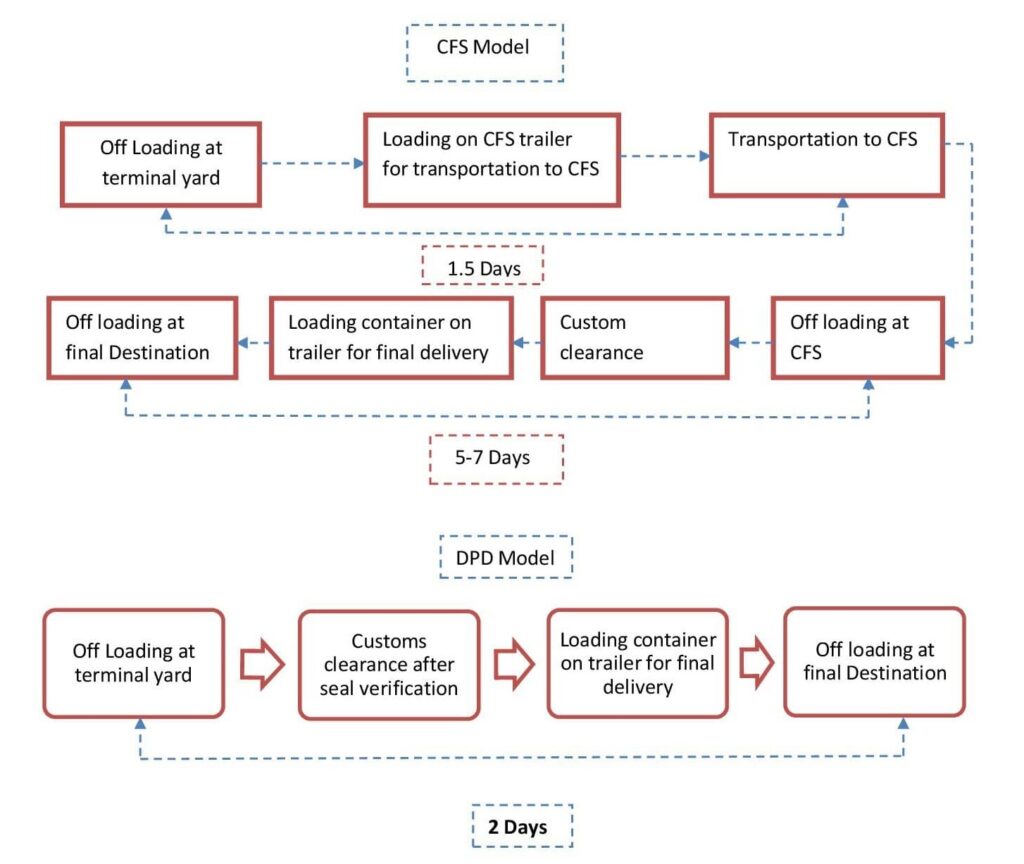

Under the DPD model, the importer can complete the customs clearance and take the shipment within 48 hours.

If the importer fails to take the delivery within 48 hours the shipment will be transferred to a CFS (container freight station).

It reduces the delivery time of import cargo from 7-9 days to 2 days. Refer to the below diagram explaining the days taken to clear the import cargo without DPD facility ie. if the cargo is transferred to CFS then to release that importer has to follow the CFS model to clear the import which may take 7-9 days. Under the DPD facility, it only takes 2 days to clear the import cargo.

The cost is reduced under the DPD model for the following:

- Importers save on storage,

- Ground rent,

- CFS handling and terminal-to-CFS transport charges

- Detention fee payable to the carrier

10K – 20K can be saved per container as per the estimation of JNPT due to faster turnaround of containers for shipping lines and 24*7 facility of clearance.

- Direct Port Entry (DPE) – For the Export

The Direct port entry (DPE) model facilitates the shippers to Gate in their factory stuffed exports directly to the container terminal enabling the direct movement of containers from factories without intermediate handling at any CFS (container freight station) on 24*7 basis.

The DPE reduces the time taken in obtaining custom approval bringing down dwell time and saving cost (70% – 100% CFS cost is reduced under DPE if the exporter is having the AEO certificate).

- 24-hour Clearance No Merchant Overtime Fees

Merchant Overtime fees are the charges paid by the exporter on services provided by the central excise officers beyond office hours (on Sunday, Saturdays or public holidays i.e. after the official hours)

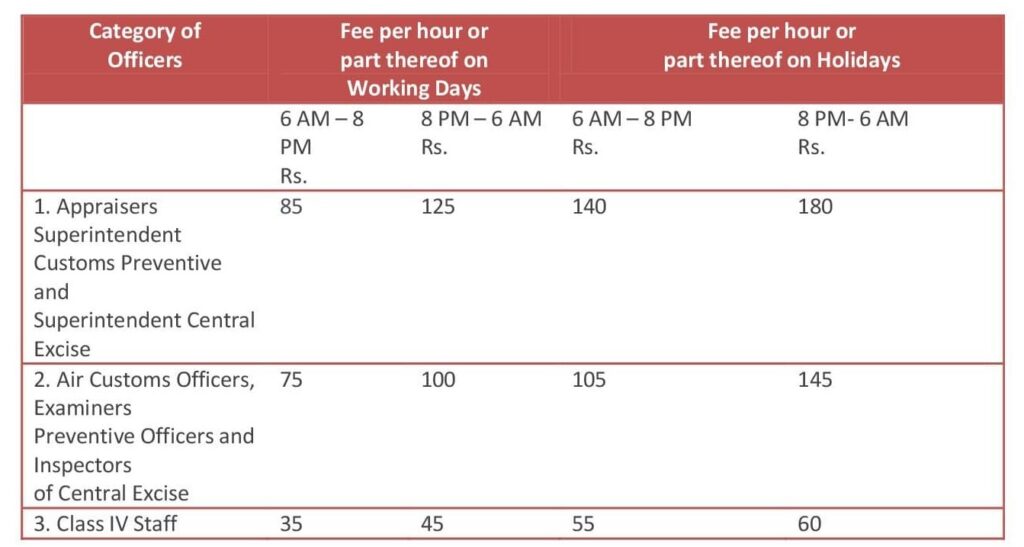

Present rates of MOT to get the services by the Customs officers are as follows:

The Exporters having AEO certificates don’t have to pay Merchant Overtime Fee.

- Email Notification:-

The AEO certificate holder will get an E-mail for the departure and arrival of the import-export consignment.

Additionally, SMS alerts are also provided by the customs department for real-time updates on the status of consignments, which adds to operational efficiency.

- Self Sealing Procedure(For AEO T2 and above)

The permission of self-sealing by using RFID e-seals is given to AEO holders which helps them to reduce the transaction costs since the exporter does not have to give MoT charges as well as it improves the timeliness of their exports.

This RFID-based sealing is recognized by multiple customs administrations under MRAs (Mutual Recognition Arrangements), enhancing the global credibility and faster processing of export consignments.

- Deferred duty payment – For AEO T2 and T3

Deferred duty payment is the process of delinking the duty payment and customs clearance which is based on the “Clear First Pay Later” principle. It was introduced for the AEOs in 2016 for speedier clearance of goods imported. The Objective of introducing the Deferred duty payment for AEO certificate holders is to enhance the ease of doing business, improve turnaround time and bring in more efficiency which results in a reduction of time and cost associated with the customs clearance process.

AEO holders also get access to a deferred account mechanism, wherein a single consolidated duty payment can be made for multiple shipments, further easing financial planning.

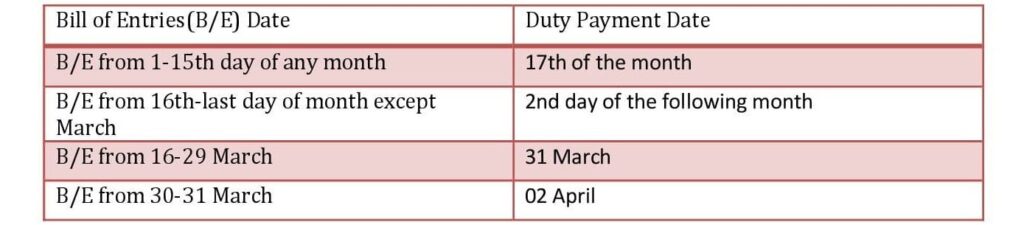

Due Dates for duty payment

Faster Processing of Incentives/Refund scheme for AEO T2 and AEO T3

- Duty Drawback

Faster disbursal of Drawback/Refund amount under Duty Drawback Scheme within 72 hours of EGM (Export General Manifest) submission.

- IGST Refund/Rebate

Faster disbursal of IGST refund and other rebates under incentive scheme within 45 days of submission of complete documents.

- Indirect Tax Investigation

Indirect Tax Investigation by the Central Board of Indirect Taxes & Customs (CBIC) shall be fast-tracked within six-nine months (If conducted)

- The dispute related to AEO

Dispute resolution related to AEO certificate between AEO holder and AEO Programme Team can be completed within 6 months

- Post Clearance Audit (PCA)

Post clearance audit(PCA) was introduced by the Government of India after cargo is released by the custom, PCA structured examination is done to check relevant commercial data, financial and non-financial records, sales contracts, physical stock, and other assets of traders.

Moreover, AEO holders are given advance intimation of audits and are allowed to respond digitally, streamlining compliance requirements.

Objective of PCA

- Increase the efficiency of customs control

- Detect and prevent fraud

- Improve traders’ compliance

- To measure and improve the traders’ compliance

Instead of regular transactional PCA (Post Clearance Audit) Onsite PCA to be done once every 3 years for AEO Holders.

All AEO holders get a higher level of facilitation in import and export consignment with the following preferential treatment.

- ID Cards

All the AEO certificate holders get the AEO ID card to get the entry in Custom house, CFS, ICD.

- Separate space

AEO holder gets the separate space in custodian premises if feasible.

- Relationship Manager – AEO T2 and above

A dedicated relationship manager would be available for AEO holders.

This manager acts as a single point of contact to resolve trade-related queries, which reduces dependency on multiple departments.

- Trade Facilitation – for AEO T2 and above

Trade facilitation by a foreign Customs administration with whom India enters into a Mutual Recognition Agreement (MRA),

It is also worth noting that many countries give preferential treatment to Indian AEO certificate holders under MRAs, reducing inspection frequency and facilitating smoother cross-border movement.

Container scanning and assessment/examination of Bill of Entry/Shipping bills are done on a priority basis.

The benefit for getting the Advance License under Self-Ratification Advance Authorization Scheme

Self-Ratification Advance Authorizations Scheme is only available to AEO Status Holders. Under this Scheme, Exporters who are availing benefits of Advance Authorization can get Advance License on Self Declaration and Self Ratification basis.

Therefore in cases where SION (Standard Input Output Norms) / Valid ad-hoc Norms for an Export Product are not fixed or where SION has been notified but the exporter intends to use additional inputs in the manufacturing process, there is no need to approach the Norms Committee for Fixation of Norms. Exporters can get the Advance License on Self Ratification basis.

Set of benefits of Star Export House / Status Holders which are not available for AEOs

There are the following benefits which are available to Status Holders/Export House Certificate but not available to AEOs-

Bank Guarantee (BG)

The Status Holders are 100% exempted from the furnishing of Bank Guarantee(BG) under the Advance/EPCG Scheme. Whereas AEO holder having AEO T1 is 50% exempted from BG, AEO T2 is 75% exempted, and AEO T3 is 100% exempted.

Establishment of Export Warehouse

As per the Department of Revenue (DoR) guidelines, 2 stars and above status holders shall be eligible to establish Export Warehouses.

Export of free-of-cost samples

Status Holders are entitled to export freely exportable items on a free of cost basis for the export promotion purpose subject to the annual limit as specified.

Additionally, Status Holders may receive priority consideration for participating in international trade fairs and buyer-seller meets organized by the Government of India or its export promotion councils.

[To know more about how to avail all the benefits available to Star Export House Holders click on – Star Export House Certificate / Status Holder Certificate]

Comparison of AEO and Status Holder/ Star Export House Certification

Refer to the summary of similarities and differentiation between AEO and Star Export House certification below:

Conclusion – Which Certification has more benefits?

Both the certificate have few common benefits, AEO certificate is more beneficial for the importers having a larger quantity of imports as there are Duty Deferment benefits available on the import. Since both the certification are not mutually exclusive, there are the set of important benefits of AEO holders which are not available for status holders and vice versa too. Considering the International recognition, fast processing of refunds/benefits, export warehouse, free export of samples, reduction in dwell time, custom cost and procedures, supply chain efficiency we suggest exporters get the Certification under both the scheme to get maximum benefits and gain a competitive edge in International Market.

As India continues to negotiate more Mutual Recognition Agreements (MRAs) with foreign customs administrations, the value of AEO certification is expected to grow significantly in facilitating global market access.

[To get all the benefits given under AEO certification it is important to know the Application Procedure, visit – How to Apply for AEO Certification/AEO Registration in India]

How Afleo can help you to get the Certification?

Afleo Consultants is a leading Import-Export Consulting firm providing DGFT and Custom related services. In-depth knowledge of the Government policies & procedures, expertise in the subject matter related to FTP and custom Procedures, notable experience in the sector has enabled Afleo to provide high-quality services to the client.

Our dedicated team of experts helps in simplifying the following AEO/ Star Export House application procedure:

- Assistance in Documentation,

- Online application to get the AEO/Status house certificate,

- Follow up with the Custom/DGFT to get the certification.

- Assistance in Physical Verification in case of AEO certification.

- Assist in maintaining the AEO/Status holder certificate.

Get In Touch With Us Now. Fill up the form below For Some Professional Support.