If you are an exporter of textiles from India, you can get benefits from the Ministry of Textile’s new RoSCTL scheme. RoSCTL stands for Rebate of State and Central Taxes and Levies. It is the rebate you receive on the garment and made-ups you export from India. RoSCTL came into effect from 7th March 2019 vide notification No. 14/26/2016-IT (Vol II). On this exact date, the Ministry of Textiles withdrew the previous Rebate of State Levies Scheme (RoSL Scheme).

It must be noted that benefits under old RoSL Scheme were given by the Customs Authority and credited directly to the bank account of the Exporter. However, the benefits under the RoSCTL Scheme are to be given in the form of duty credit scrips similar to scrips issued under the Merchandise Exports from India Scheme (MEIS).

RoSCTL Scheme Eligibility Criteria

- For all the export made after 1.4.2019 i.e during the Financial year 2019-20 onwards, the scrip will be issued by the DGFT under the new RoSCTL Scheme.

- For the Export made during the financial year 2018-19 between the dates 7.3.2019 – 31.3.2019, the Department of Revenue will approve and will give rebate with the new rates of RoSCTL Scheme but under the old RoSL mechanism(i.e Direct Bank Transfer through Customs). The rebate will be given from the available fund for the RoSL Scheme and if due to the shortage of funds the Department of revenue is unable to disburse, the Department of Revenue will inform the DGFT after 31.3.2019 and the DGFT will provide the scrip.

- For the Export done prior to 7.3.2019 the rebate will be given according to the rate of the Old RoSL Scheme Mechanism. The Department of Revenue will be disbursing the funds with the allotted fund for the RoSL scheme and if there is a shortage of funds in any case, the Department of Revenue will inform DGFT after 31.3.2019 and the DGFT will issue the scrips for such exports made but with the old RoSL rates.

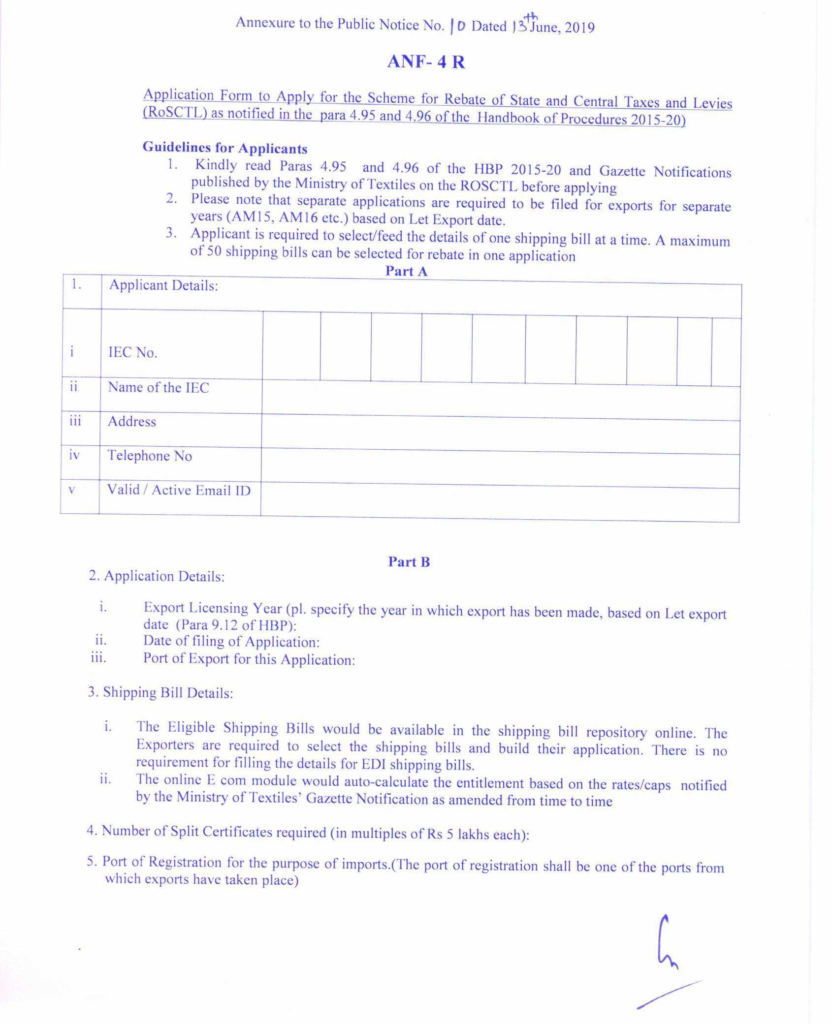

RoSCTL Application procedure and requirements.

- To claim rebate on exports under the RoSCTL scheme you have to fill ANF4 R using the Digital Signature and submit it online to Jurisdictional DGFT Office. Please find the form below:

- You have to fill the details and attach the relevant shipping bills online. Maximum of 50 Shipping bills can be attached in a single application.

- Also unlike the MEIS Scheme, Linking of e-BRCs is not required for applying under RoSCTL Scheme.

- The applicant has to file the application within one year of the date of uploading of the shipping bills from ICEGATE to the DGFT server. After the duration of one year of uploading the shipping bills, the bills will be time-barred and no application can be made.

- There is no Late cut fee under the RoSCTL Scheme. The Scheme is eligible only for the exports made till 31.03.2020.

- Port of Registration for RoSCTL while filing Online Application:

- Shipments from EDI Ports and Non-EDI Ports cannot be clubbed in one application. For the export made from any EDI enabled Port, the port of Registration will be the same.

- For the Export Made from a Non-EDI Port, the port of registration shall be the relevant non-EDI Port, a separate application has to be filed for each non-EDI port.

- The online system of DGFT will electronically process the application and the scrip will be issued based on a system-based approval/check mechanism. The Scrip will be delivered by hand or by post depending on the option selected by the applicant during submitting the online application.

- In order to get the script, you must apply to your concerned DGFT Regional Office.

- Once you receive the Duty Credit Scrip, it will be valid for two years from its date of issue. Please note that it has to be valid on the date of the actual debit of duty. You cannot revalidate the Duty Credit Scrip unless the revalidation is covered under paragraph 2.20 (c) of the Handbook of Procedures.

Recovery mechanism and Maintenance of RoSCTL

- You must maintain a record of shipping bills and other documents related to export for three years from the scrip issuance date. The RA, Licensing Authority, or any other agency can ask to check all the original documents at any time within three years. If you fail to submit the original documents when the agencies ask for them, you will have to repay the granted scrip amount in cash, plus the accrued interest. You may also be penalized as per the FTDR Act.

- The rebate that you can receive depends on your sale proceeds (Realization of Foreign Currency) in the time frame allotted under the Foreign Exchange Management Act of 1999. If you don’t furnish the sale proceeds receipt, the RA will revoke permission for the rebate.

- The RA will examine the electronic records of your scrip and if they think they issued you more than the amount you were entitled to and if the records show this to be a fact, the RA will ask for an explanation. Also, as per paragraph 3.19 of FTP, you will have to repay the excess amount and its accrued interest. This will be 15% per annum and it will be from the debit date of the scrip to the repayment date. There will be no interest charged if you return the rebate amount unused. However, you may be penalized for not declaring the overpayment or practicing fraud. If you don’t repay the amount or don’t reply to the RA within 30 days of receiving their notice, the RA will initiate legal action against you as per the FTDR Act.

Why Afleo?

The RoSCTL application can be complicated, but fortunately, Afleo has a knowledgeable and dedicated staff that can guide you through the entire process. We can provide you with detailed information about the documents you need and the steps you need to take. Get in touch and we will be happy to respond to any of your queries.