India Australia Economic Cooperation and Trade Agreement [ECTA]

Table of Contents

India Australia Economic Cooperation and Trade Agreement [ECTA]

- India-Australia ECTA: Brief Overview

- Key Achievements of the Agreement

- 1. India Australia Free Trade Agreement Benefits?

- 2. Major Export & Import Sectors Benefiting from ECTA

- 3. India Australia Free Trade Agreement Products List?

- 4. Tariff Elimination & Reduction Schedule

- 5. What are the Rules of origin criteria?

- 5.1 Product Specific Rules of Origin

- 5.2 Article 4.8 - De Minimis

- 5.3 Minimal Operations or Insufficient Processing

- What qualifies as “minimal operations”?

- Why is this important?

- 6. Eligibility Criteria for Indian Exporters to Avail Benefits

- 7. How & Where to apply For Certificate of Origin [CoO] under India Australia ECTA - Free Trade Agreement?

- 8. ECTA vs CECA: What's the Difference?

- 9.FAQs on India-Australia ECTA

- 10. Need Help With Your ECTA Certificate of Origin?

- 11. Who are We and Why Choose Us.

India-Australia ECTA: Brief Overview

The India-Australia Economic Cooperation and Trade Agreement (ECTA) is India’s first trade deal with a developed country in over a decade and marks a strategic pivot toward the Indo-Pacific. Signed on 2 April 2022 and implemented on 29 December 2022, it eliminates or slashes customs duties on the vast majority of two-way merchandise trade. For Indian firms, the agreement opens a market with one of the world’s highest per-capita incomes while also securing a dependable supply of critical minerals from Australia. Beyond tariff lines, ECTA contains provisions on services, investment facilitation, sanitary and phytosanitary (SPS) measures, and mutual recognition of professional qualifications—each of which reduces hidden trade costs for exporters. Together, these features are expected to double bilateral trade to USD 50 billion within five years and generate roughly one million Indian jobs.

Key Achievements of the Agreement

ECTA provides zero-duty access to 96 percent of India’s exports to Australia on day one, covering over 6,000 tariff lines. Australia, in return, enjoys lower duties on critical inputs such as coal, alumina, and wool—items that directly support Indian downstream industries. The pact also institutes fast-track customs clearance with a 48-hour release target for perishable cargo, a crucial advantage for India’s seafood and fresh-produce exporters. A dedicated Chapter on Technical Barriers to Trade (TBT) sets up a standing committee to iron out standards issues before they become costly disputes. Finally, the agreement introduces a time-bound review clause, allowing both sides to upgrade commitments to a wider CECA (Comprehensive Economic Cooperation Agreement) once initial goals are met.

1. India Australia Free Trade Agreement Benefits?

We all know that FTA gives preferential tariff access to Indian Export products in the Importing country.

One such FTA is recently announced India-Australia ECTA. Ind-AUS ECTA was signed in April 2022, and has become operational since 29th December 2022.

So why is this FTA so important? – Over 96% of India’s exports to Australia by value will be getting duty free access under the India Australia Economic Cooperation and Trade Agreement immediately from the start date of this agreement. And remaining product lines getting duty free access gradually in the coming 5 years

Most Textiles and Apparel, Some agricultural, fisheries products, leather, footwear, furniture, sports goods, jewellery, machinery, electrical goods, railway wagons, also select pharmaceutical and medical goods will be among the biggest beneficiaries of this trade agreement.

Australia on the other hand is a supplier of raw materials and intermediates, minerals and things like that, which are very useful for the Indian Industry, because if our raw materials are cheaper then the final product is also cost competitive in the world markets. So this agreement is a win-win situation for both the countries.

2. Major Export & Import Sectors Benefiting from ECTA

Indian textiles and apparel instantly gained duty-free status, letting manufacturers compete head-to-head with ASEAN suppliers in Australian retail chains. Gems and jewellery—especially plain and studded gold jewellery—have become 4–5 percent cheaper at the Australian border, boosting demand ahead of the Southern Hemisphere festival and wedding seasons. In pharmaceuticals, faster regulatory approvals for generics mean more predictable launch calendars and lower compliance costs. Engineering products such as industrial machinery and auto components enter on phased-down duty rates, giving MSME suppliers breathing room to scale up. On the import side, concessional duties on Australian critical minerals, wines, and premium wool reduce India’s input costs and diversify supply chains away from single-country dependencies.

3. India Australia Free Trade Agreement Products List?

The list of all such products HS code wise is given in ANNEX 2A – Schedule of Australia. The link of this PDF file is shared below –

[Link for ANNEX 2A – Schedule of Australia – https://commerce.gov.in/wp-content/uploads/2022/06/02A-2-Schedule-Australia.pdf]

This list shows HS Code, Product Description, base rate and the Staging category. The Staging category is of two types i.e. A & B5

Staging Category A means there will be 0% Import duty in Australia from 29th December 2022 itself.

Staging Category B5 means there will be 0% Import Duty in Australia at the end of 5 years, and every year the import duty will be reduced in equal installments.

Let us understand this by way of an example, please see the table below –

HS Code Description Base rate Staging category 6302.12.10 Curtains 5% A 7208.10.00 FLAT-ROLLED PRODUCTS OF IRON OR NON ALLOY STEEL, -In coils, not further worked than hot-rolled, with patterns in relief 5% B5 (Example of products with category)

In this table it can be seen that “Curtains”, which currently has an Import duty of 5%, will immediately become 0 from 29th December 2022.

And “Flat rolled products” under chapter 7208 which currently has an Import duty of 5%, will be reduced in equal installments i.e. 4%, 3%, 2% and so on and it will eventually become zero by the end of 5 years.

You will get all the information in the below video like – Is the Agreement beneficial for you? Which products are eligible? What are the rules or origin? How can you apply for CoO under this Free Trade Agreement? Where to apply? What are the documents required? What are the obligations on the part of the exporter? Etc. So Let’s get started.

4. Tariff Elimination & Reduction Schedule

Roughly 90 percent of eligible tariff lines dropped to 0 percent immediately on 29 December 2022. Sensitive industrial inputs—e.g., certain steel and aluminium items—will phase to zero over five years, giving Indian producers time to adjust. A select list of highly sensitive farm goods, such as dairy and wheat, remains excluded to protect vulnerable Indian growers; these lines will be reviewed only after sustained consultations. Importantly, Rules of Origin (RoO) require either a Change in Tariff Heading (CTH) or 35 percent Regional Value Content for most products, ensuring that simple trans-shipment from third countries cannot exploit the preference. Customs authorities on both sides have also committed to handling e-CoO verifications in under ten business days, speeding up GST refund cycles for exporters.

5. What are the Rules of origin criteria?

So the rules of origin is a very important section. A product will be considered of Indian origin only if 1. It is wholly obtained or Produced in India or 2. Produced entirely in India using non-originating materials [i.e. imported materials]

We will understand each By way of an Example:

Wholly obtained in India means the products that are entirely grown in India or produced using 100% Indian raw materials. A common example of such products would be fruits & vegetables that are grown in India.

So the 1st criteria is pretty simple and clear.

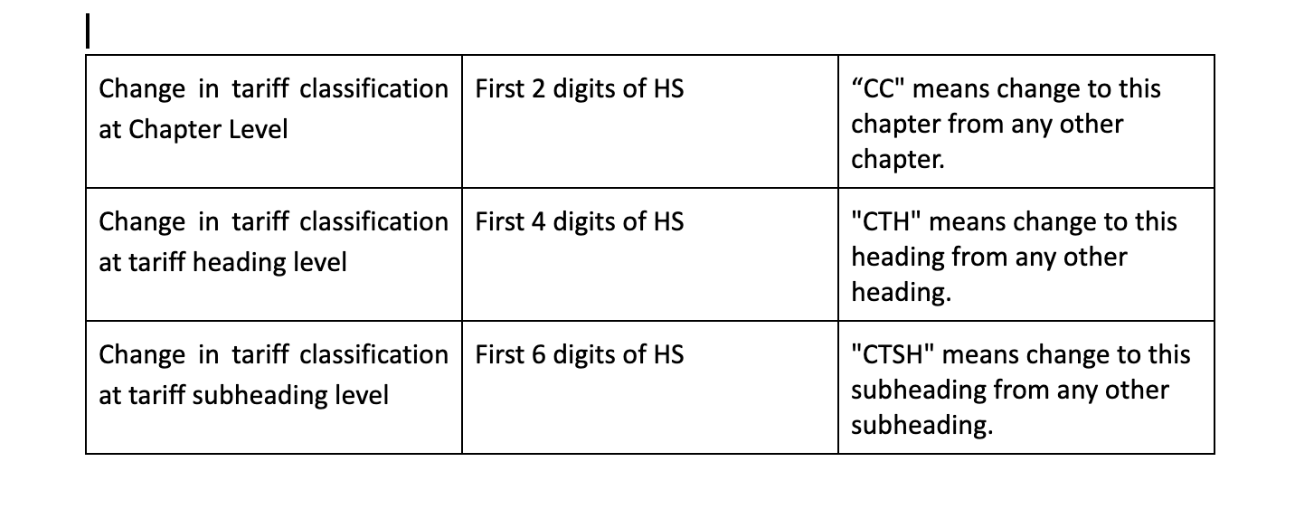

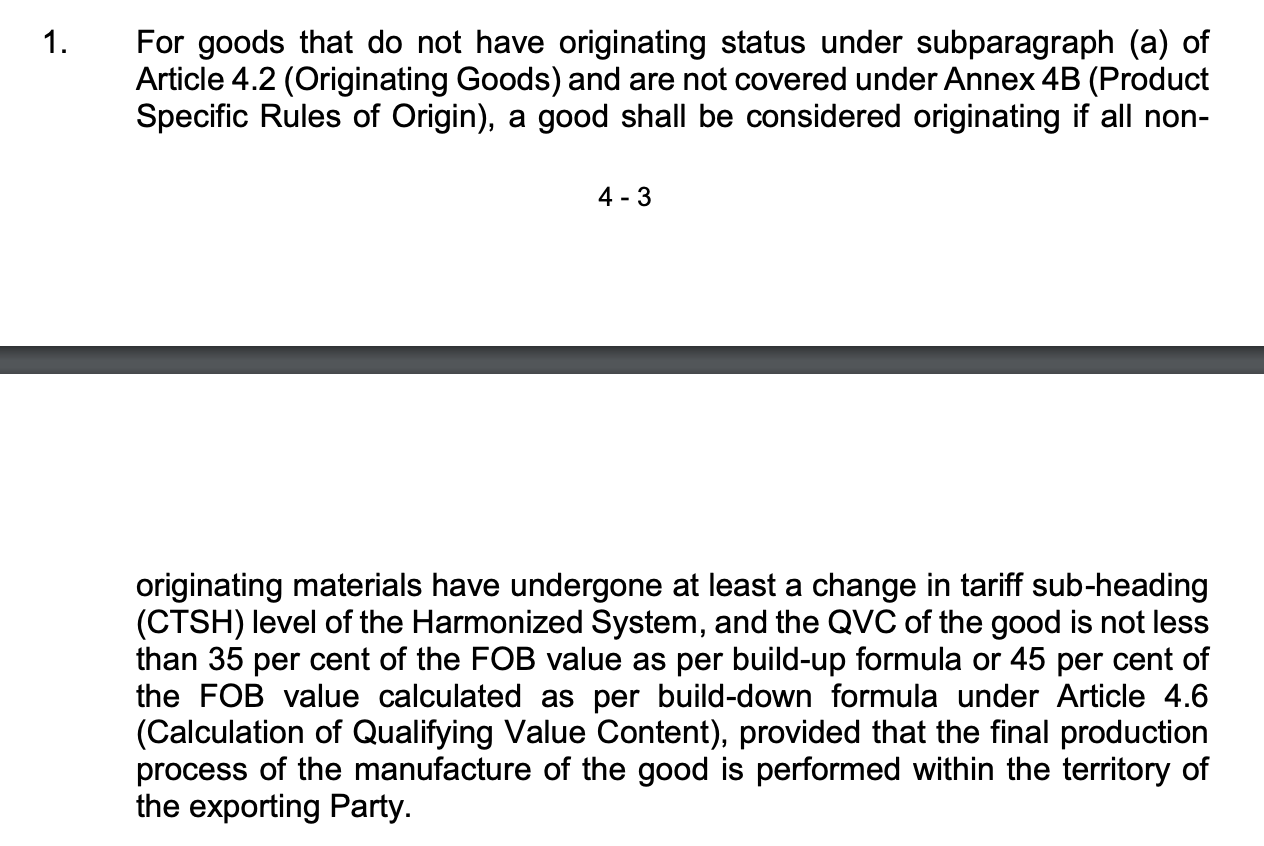

Regarding the 2nd Criteria, a product will be considered as originating from India if it undergoes change in tariff classification at Chapter Level [CC] i.e. First 2 digits of HS / tariff heading level [CTH] i.e. First 4 digits / tariff subheading level [CTSH] i.e. First 6 digits AND/OR it satisfies the QVC [Qualifying Value Content] criteria. This will be explained in detail in the Product Specific rules section.

AND/OR

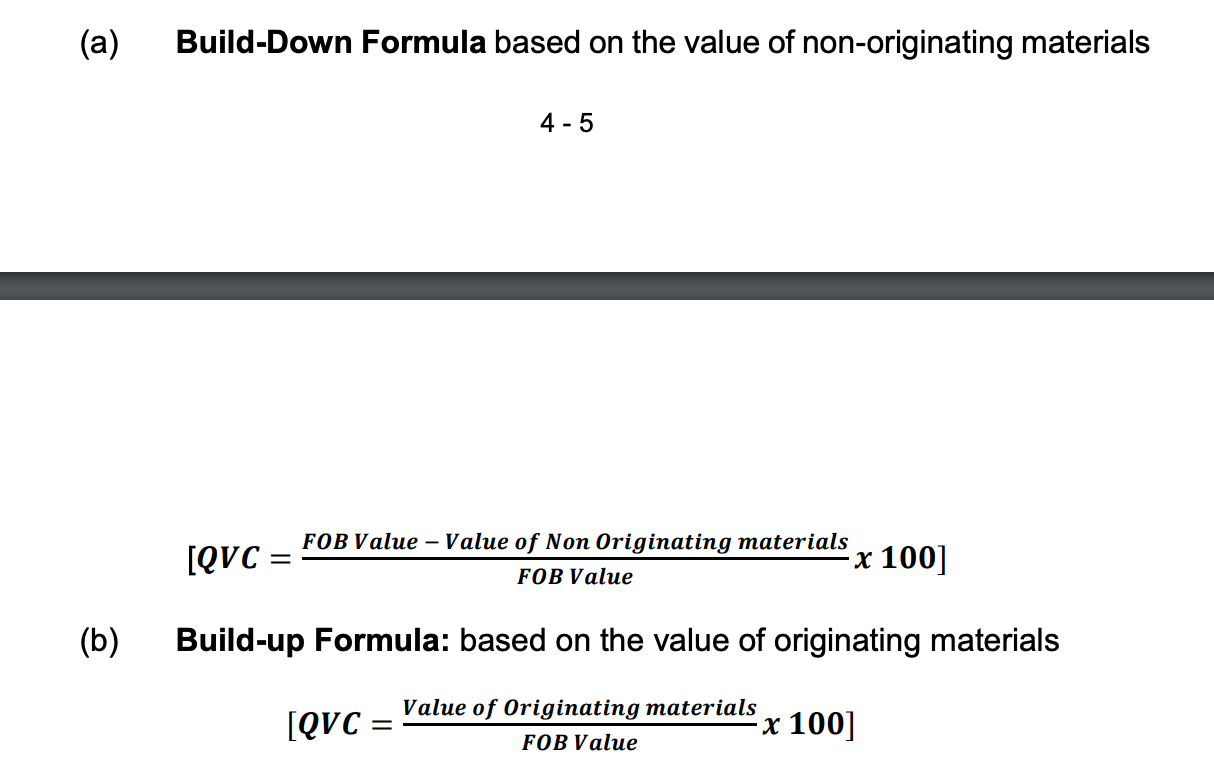

The QVC shall be calculated using one of the following methods:

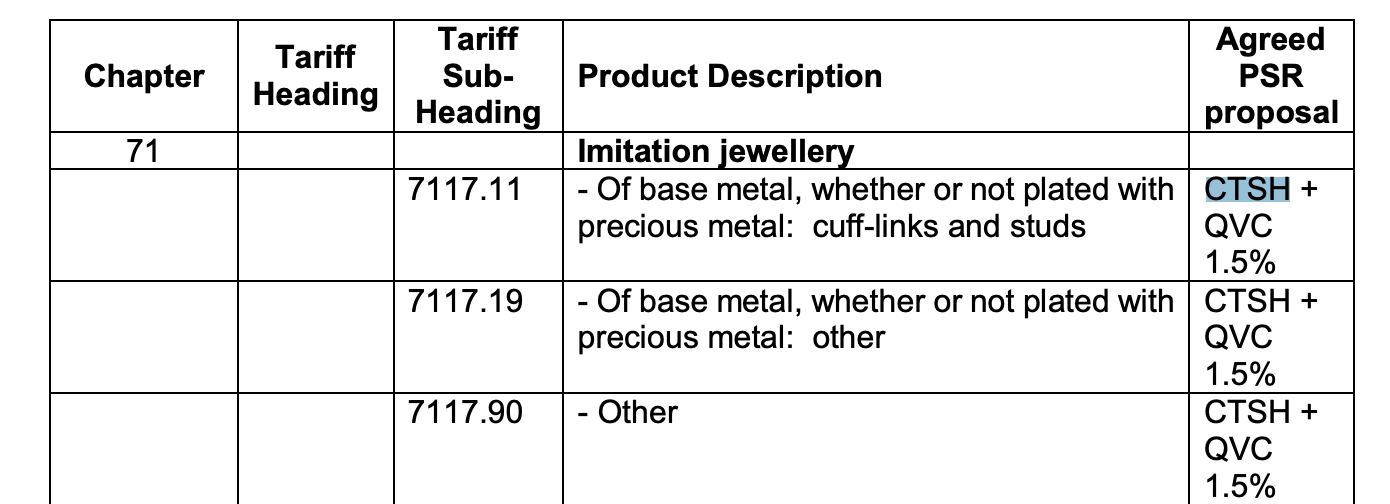

5.1 Product Specific Rules of Origin

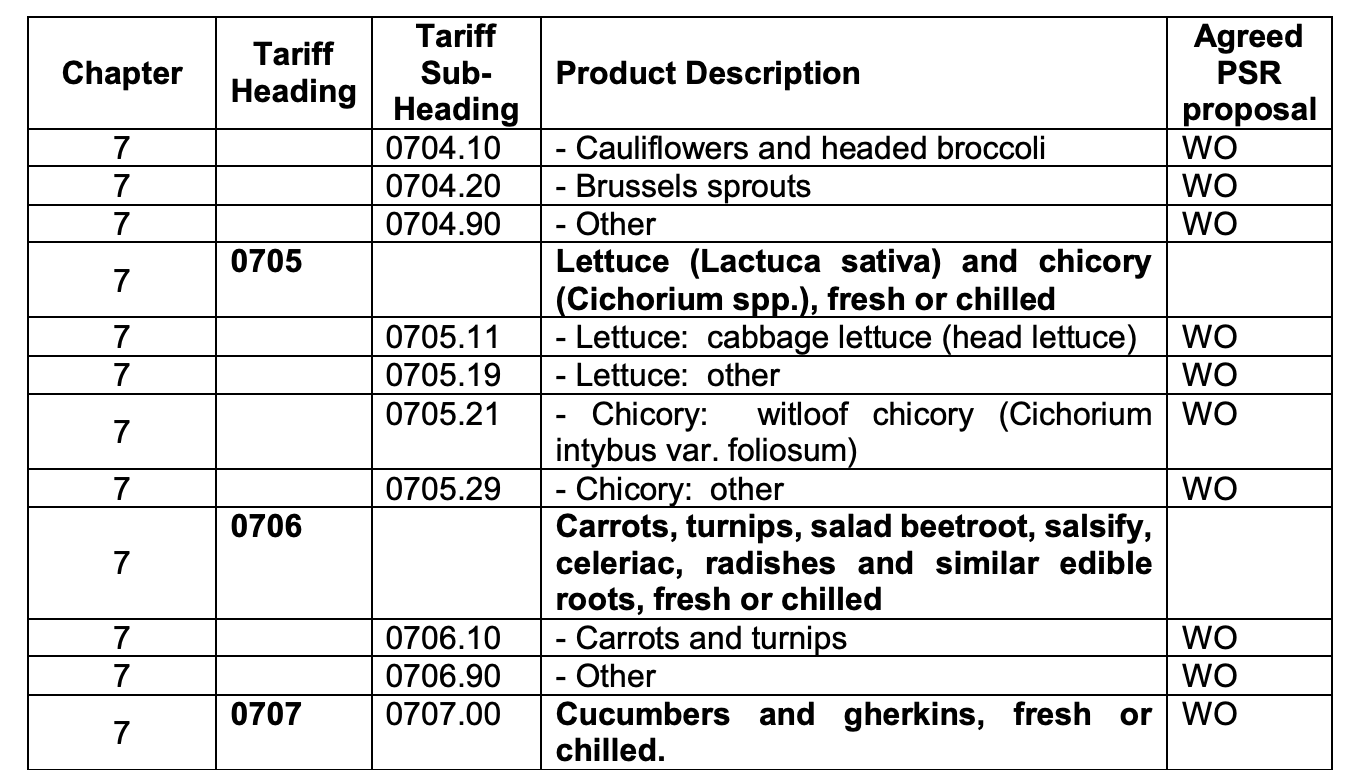

(Example 1 – Product Specific Rules of Origin)

The Image shows that for the above products to qualify for the duty free access benefit, it should be Wholly Obtained [WO] in India.

Example 2 –

(Example 1 – Product Specific Rules of Origin)

The Image shows that for the above products to qualify for the duty free access benefit, it should be Wholly Obtained [WO] in India.

Example 2 –

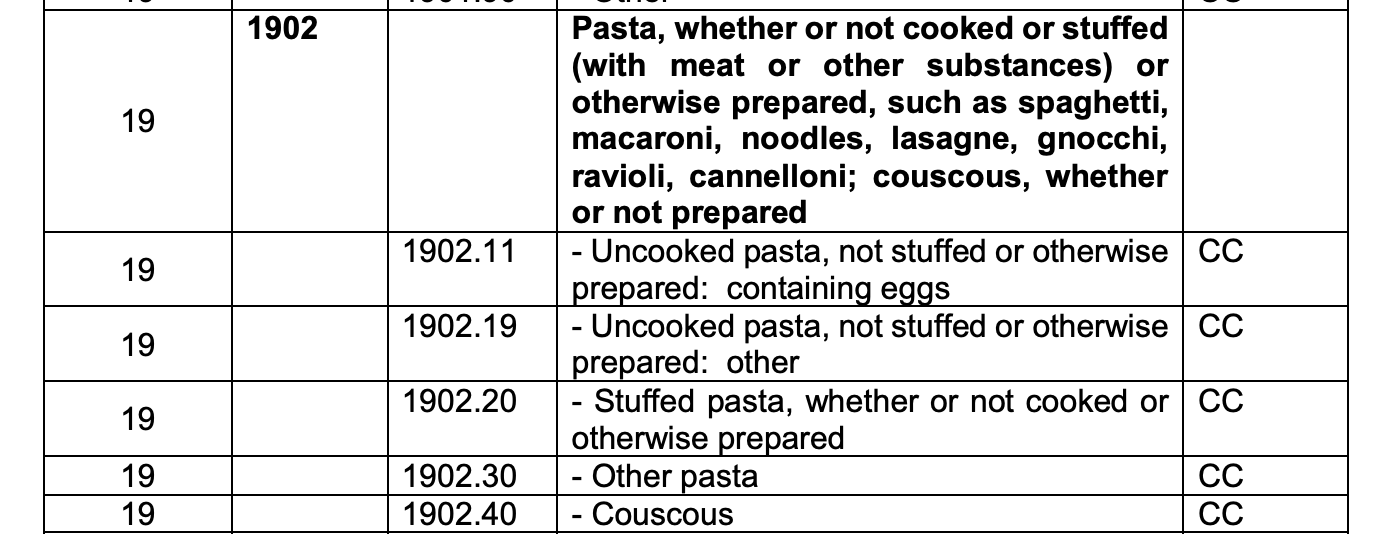

(Example 2 – Product Specific Rules of Origin)

So in this example the export product i.e. Pasta of various types will qualify for the ECTA benefits only if it has undergone a change in CC. It means that all non-originating materials used in the production of the good have undergone a change in tariff classification at the two digit level; i.e. First 2 digits of all imported Raw materials [Non-originating materials] are different from First 2 digits of the final export product.

Example 3 –

(Example 3 – Product Specific Rules of Origin)

So in this example the export product i.e. Imitation Jewellery will qualify for the ECTA benefit if it satisfies both the criteria’s i.e. CTSH + QVC 1.5% i.e. First 6 digits of all imported Raw materials [Non-originating materials] are different from First 6 digits of the final export product AND QVC of not less than 1.5% using the build-up method or build-down method.

It should be noted that, the PSR of all the products are not notified yet, this will be an ongoing process. So if your export items are not covered under the Product specific rule of origin, then to determine whether the goods are origination from India, a General Rule as per the below Image should be used:

If there are many export items in the Invoice then VA for each export item should be calculated separately. Maybe it is possible that some of your items are not fulfilling the PSR criteria, then in those cases you have to mention that in your documents & ECTA benefits for those products should not be taken.

Also, In order to calculate the QVC value correctly Please refer to Sub para 5, 6, 7 & 8 of Article 4.6 under Chapter 4 – Rules of origin.

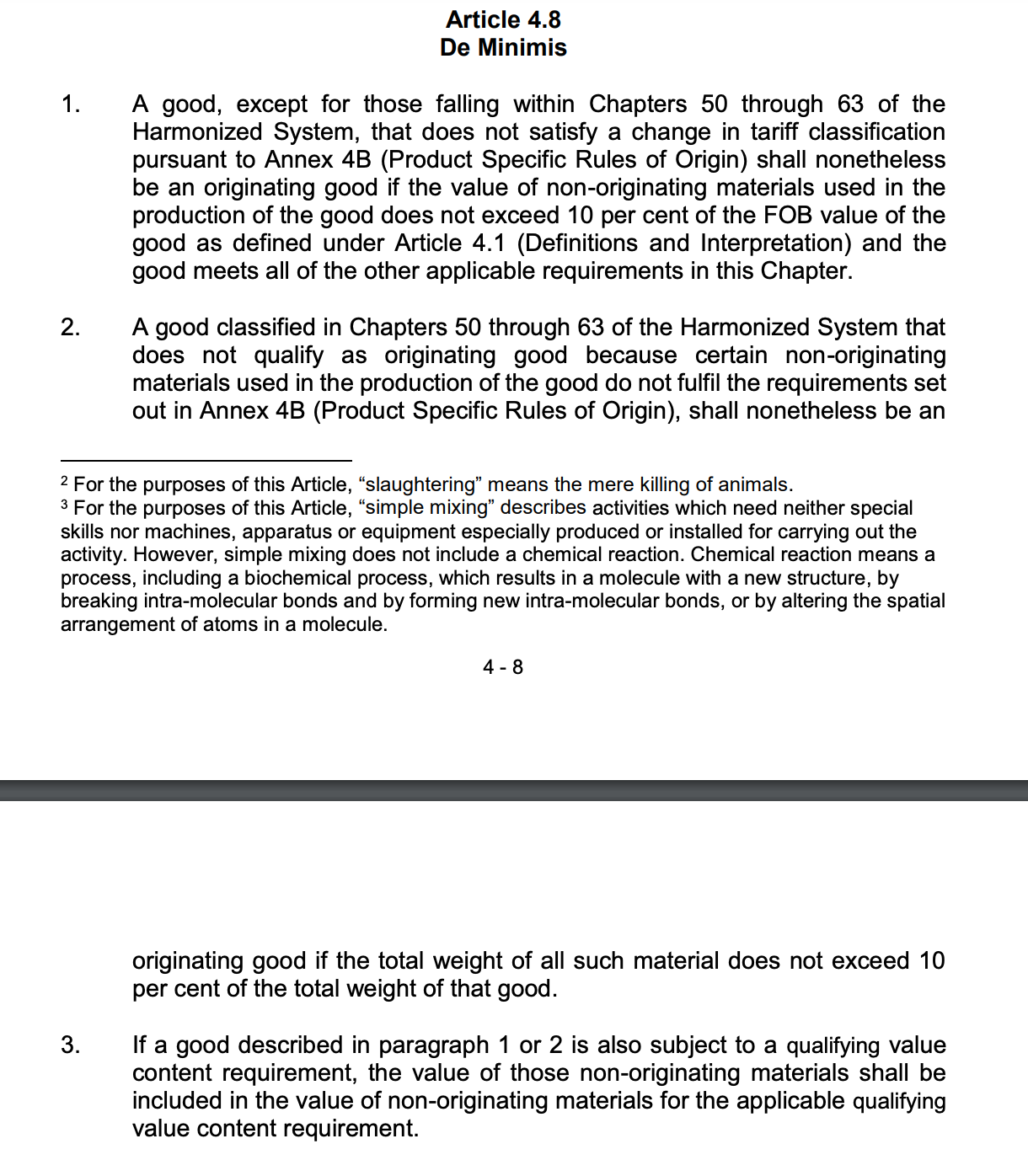

5.2 Article 4.8 - De Minimis

Now, many times it may happen that, you use 5 to 6 non originating materials to make a final product. But one or two of your non originating materials are not able to satisfy the criteria of change in tariff Classification rule i.e. CC or CTH or CTSH.

In such cases Article 4.8 under Chapter 4 – Rules of origin can be of help. It states that,

For Export Products falling under Chapters except 50 to 63, such goods will be considered as originating if the value of all such non originating materials is less than 10% of the FOB Value of Export Goods.

And for all the Export products falling under Chapters 50 to 63, such goods shall be considered as originating if the total weight of all such non originating material does not exceed 10 percent of the total weight of that export good.

5.3 Minimal Operations or Insufficient Processing

Under the India-Australia ECTA, to claim preferential tariff benefits, exported goods must meet specific Rules of Origin (ROO). These rules are in place to ensure that the product has undergone substantial transformation in the exporting country. Merely performing minimal operations or insufficient processing does not qualify a product as originating.

What qualifies as “minimal operations”?

Minimal operations are basic activities that do not add substantial value to the product. Examples include:

- Simple packaging, repacking, or relabeling

- Mere dilution with water or other substances

- Washing, cleaning, or ironing of garments

- Simple assembly of parts to constitute a complete product

- Affixing marks, labels, or other similar distinguishing signs

- Simple mixing of products, provided the characteristics of the product remain unchanged

Why is this important?

If your exported product only undergoes these minimal operations in India, it will not qualify for duty concessions under ECTA—even if it is shipped from India. The product must undergo a transformation that meets the applicable Product-Specific Rules (PSR) or a Change in Tariff Classification (CTC), and often a minimum value addition threshold.

Tip: Always check Annex 3B of the ECTA for the applicable Product-Specific Rule and avoid relying solely on reprocessing or repackaging activities.

6. Eligibility Criteria for Indian Exporters to Avail Benefits

To claim the concessional duty rates under the India-Australia ECTA, an exporter must hold a valid IEC (Importer-Exporter Code) and be registered on the DGFT’s electronic Certificate-of-Origin (e-CoO) platform. The goods must meet the Product-Specific Rules of Origin prescribed in Chapter 4 of the agreement—either “wholly obtained” in India or satisfying the 35 % Indian value-addition/CTH (Change in Tariff Heading) test. Exporters are also required to maintain origin records for at least five years and be ready for post-export verification by Indian or Australian customs. In addition, each shipment must be covered by a digitally-signed CoO issued by an authorised Indian agency; without this document, Australian Customs will not extend the preferential rate. No separate REX registration is necessary for ECTA, but adherence to the self-declaration statements printed on the commercial invoice is mandatory where permitted by DGFT guidelines.

7. How & Where to apply For Certificate of Origin [CoO] under India Australia ECTA - Free Trade Agreement?

Application for CoO under CEPA is to be done on the CoO common digital platform. It is a compulsory online process.

Application should be filed within 5 days from the date of export.

Common set of documents required are:

1. Digital Signature

2. Exports Invoice copy

3. Packing List

4. Bill of Lading

5. Shipping Bill.

Once the application is done the CoO is issued within one to two working days.

8. ECTA vs CECA: What's the Difference?

The ECTA is deliberately “early-harvest”—it tackles tariff barriers on goods first, plus a narrow menu of services, to deliver quick wins while the two sides hammer out deeper commitments. By contrast, the proposed India-Australia CECA aims to cover next-generation issues such as digital trade, investment protection, government procurement, and high-value professional mobility. CECA would also incorporate binding disciplines on e-commerce data flows and a negative-list approach on services, features absent from the ECTA. In effect, ECTA is the on-ramp that builds trust and momentum; CECA will be the full multilane highway. The review clause written into ECTA guarantees that negotiations for CECA can start with a solid baseline of proven commercial gains.

9.FAQs on India-Australia ECTA

What is the India-Australia Economic Cooperation and Trade Agreement (ECTA)?

ECTA is a bilateral trade agreement that seeks to cut or remove tariffs, increase investments, and create job opportunities between India and Australia.

When did the India-Australia ECTA take effect?

The ECTA became operative on December 29, 2022.

What are the key advantages of ECTA to Indian exporters?

Goods covered are apparel, gems and jewelry, leather, engineering goods, auto parts, and food items. A complete list is provided in the ECTA schedule.

Which products are included under the India-Australia ECTA?

Exporters need to apply online from the DGFT website by choosing the scheme of ECTA, uploading documents, and paying fees as applicable.

What documents are required for CoO application under ECTA?

According to Article 4.8 of ECTA, products may qualify as originating even with a small percentage of non-originating materials (typically up to 10%).

Can exporters use third-country invoicing under ECTA?

Yes, third-country invoicing is allowed under ECTA, subject to conditions outlined in the agreement.

Is there any validity period for the Certificate of Origin under ECTA?

Yes, generally, the CoO is valid for 12 months from the issuance date, unless otherwise mentioned

What is the distinction between ECTA and CECA?

ECTA is an interim agreement mainly dealing with goods and restricted services, whereas CECA is a proposed all-encompassing agreement covering digital trade and investments, now under negotiation.

10. Need Help With Your ECTA Certificate of Origin?

Afleo is an authorised agent on the DGFT e-CoO platform and can handle end-to-end CoO issuance—from HS-code classification and origin computation to real-time application tracking. Reach out to our trade-compliance team, and we’ll make sure your goods clear Australian customs at the lowest possible duty rate, hassle-free and on time.

11. Who are We and Why Choose Us.

We at Afleo Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding]. With our vast knowledge and experience in this field we can represent your case for all the activities pertaining to the Country of Origin and get it cleared in a hassle free manner.

So do get in touch with us for any of your requirements and our team will be happy to help you.

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA