AD Code Registration on ICEGATE – Process, Documents & Updates

List of Services

AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License - Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of Duties or Taxes on Export Product (RoDTEP)

- Merchandise Exports from India Scheme (MEIS)

- Services Exports from India Scheme (SEIS)

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of Origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India–Dubai CEPA, etc.

- Import Monitoring System (IMS) – Steel IMS, Coal IMS, Copper/Aluminium IMS, Chip IMS

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- FREE SALE AND COMMERCE CERTIFICATE.

- Abeyance Cases for IEC’s in DEL.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation - Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) - Proudly representing 20+ cases every month.

- EPCG Committee Approvals - Handling 10+ complex cases every month

- Permission for Restricted/Negative list of Import Items & Export Items - Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from the Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First-time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding - Import & Export

- Air freight - Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips - MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Table of Contents

AD Code Registration on ICEGATE – Process, Documents & Updates

What is an AD Code and Why is it Important

AD Code stands for Authorised Dealer Code, a unique 7-digit number issued by the Reserve Bank of India (RBI) to banks authorized to deal in foreign exchange.

When an exporter or importer opens a current account with an AD bank, they can request the bank to issue an AD code letter. This AD code must be registered on the ICEGATE portal and is used while filing essential export/import documents like shipping bills or bills of entry.

The AD code is crucial because it ensures that all foreign exchange transactions related to exports and imports are legitimate and traceable through approved banking channels. Without registering the AD code at the port of export or import, customs authorities will not allow clearance of shipments, causing delays in trading operations.

Importance of AD code.

Without an AD code, importers and exporters cannot file shipping bills or bills of entry, making it impossible to complete customs clearance.

Other benefits of AD Code Registration:

- Enables direct credit of export incentives to the trader’s account

- Confirms that all transactions go through legal banking channels

- Required for import payment remittance and export receipt compliance

- Essential for submitting customs documents online

- Mandatory for tracking foreign exchange transactions by RBI

- One-time registration on ICEGATE simplifies future port operations

- Plays a critical role in smooth customs clearance by linking financial and regulatory systems

Watch this short video on ICEGATE AD Code & IFSC Registration. It explains the application process, the documents you need, and how we at AFLEO Group make the process easier, faster, and error-free.

Step-by-Step Process for AD Code Registration on ICEGATE:

Before you register your AD code, make sure your company is already registered on the ICEGATE portal. This includes submitting your IEC, PAN card, email address, and mobile number. This is a one-time process.

Once your ICEGATE account is active, follow these steps to register your AD Code:

- It is compulsory to first digitally sign the documents required for the AD Code and IFSC Code registration.

- Visit www.icegate.gov.in

- Log in with your User ID and Password

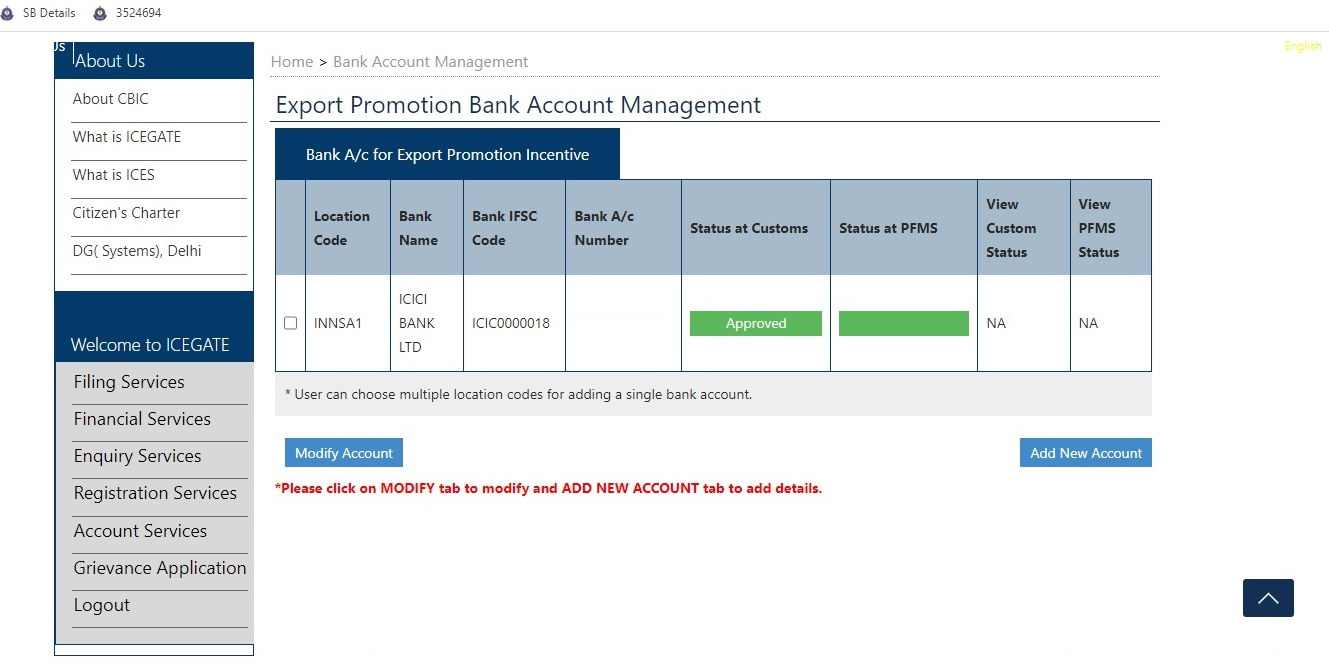

- Go to Profile > Bank Account

- Click on Foreign Remittance A/C (AD Code)

- Click Add New Bank Account

- Select your Bank Name and Branch

- Auto Capture your AD Code (from bank letter)

- Enter your Bank Account Number

- Select the Customs Port/Location

- Upload the AD Code Letter from your bank

- Click Submit

- Generate OTP, enter the OTP, and click Submit

Note: For refund or incentive purposes, register the IFSC code separately under ‘Refund/Incentive A/C’ in the same profile section.

Documents Required for AD Code Registration on ICEGATE:

Ensure you have soft copies (PDF/JPG) of the following:

- AD Code Letter on bank’s letterhead

- Copy of IEC Certificate

- Copy of GST Registration

- Cancelled cheque of the registered bank account

- Company PAN Card

- Board Resolution (for Pvt Ltd/Ltd companies)

- Bank Certificate with AD Code (if required by port)

- Copy of PAN and Aadhar Card of the authorized signatory

- Passport-size photo of the authorized person

- Class 3 Digital Signature Certificate (DSC)

- Filled-in application form (as per bank/customs requirement)

Latest Updates:

As per the latest CBIC circular (2023)/Customs Public Notice No. 93/2020, AD code registration is now required at only one port. Once registered, the AD code will be automatically reflected for all other ports under the same IEC.

However, IFSC code registration must still be done port-wise separately. This is essential for receiving duty refunds or incentives like IGST credit at the correct bank account.

What is IFSC Code?

IFSC (Indian Financial System Code) is an 11-digit alphanumeric code assigned to each bank branch by the RBI. Exporters must register their IFSC code with ICEGATE to receive incentives like duty drawback and IGST refunds directly into the correct bank account.

The IFSC code must exactly match the bank details provided in your AD code registration. Incorrect IFSC entries can lead to payment failures or delays in refunds.

How Can We Help You

We at AFLEO Group are a team of experienced DGFT and Customs Consultants with over 10 years of expertise in Exim compliance and freight logistics.

Whether you’re stuck with the ICEGATE registration, DSC errors, bank letter formats, or just want someone to handle it end-to-end, our experts can get your AD Code and IFSC registration done accurately and quickly across any port in India.

We also offer technical support for Digital Signature Certificate (DSC) and Java compatibility issues—common roadblocks on the ICEGATE portal.

Once your application is submitted, you will receive a Reference Number (IRN) which can be used to track the status of your AD code registration on the ICEGATE portal.

So, reach out to us today for hassle-free AD Code Registration.

FAQ’s on AD code registration at Icegate:

What is AD code registration?

How do one register AD code?

It can be done online after obtaining registration with the ICEGATE portal.

How do I cHow to check AD code status?laim RoSCTL benefits?

After opening a current account with a registered authorised dealer, the dealer receives a 7-digit code that serves as proof of his registration with the Reserve Bank of India. This seven-digit code is the AD code for an importer or exporter.

How does an importer/exporter get AD code?

The Rebate of State and Central Taxes and Levies (RoSCTL) Scheme is valid upto 31st March 2024.

How does registration of AD code help?

It helps in getting the incentives and benefits directly credited into the Bank account. Also it helps in getting the export proceeds realized or allows repatriation of the funds for imports done.

Can multiple AD codes be registered for one port location?

No, an IEC holder may only have one AD code bank account registered for one Port location.

Is AD code mandatory for importers as well?

Yes, it is required for importers. The importer will be unable to file the bill of entry at customs without an AD code.

Can I use the same AD Code at multiple ports?

Yes. As per the latest CBIC update, once you register your AD Code at one port, it becomes visible across all ports linked to your IEC. However, IFSC code registration is still required port-wise for refund processing.

What documents are needed for AD Code registration on ICEGATE?

You’ll need an AD Code letter from your bank, IEC certificate, GST registration, cancelled cheque, company PAN, director’s ID proof, board resolution, and Class 3 DSC. (See full list above.)

How long does ICEGATE take to approve AD Code registration?

If all documents are in order and your DSC is working properly, approval is typically instant or within 24 hours.

What if ICEGATE shows an error during submission?

What if ICEGATE shows an error during submission?

Do I need to re-register AD Code if I change my bank?

Yes. A new AD Code must be obtained from your new bank and registered on ICEGATE, mapped to the correct port.