MSME stands for Micro, Small and Medium Enterprises. These industries offer economic stability to the country. Government schemes offer the small and micro-scale industries the provision of handling their business by lending them benefits and incentives for running them efficiently.

Why are MSME Schemes offered to Start-ups and Entrepreneurs?

Most of the MSMEs are run by individuals who lack the required amenities, resources, infrastructure and linkages with the market for selling their products, thus leading to their shut-down. They do hold much potential and when rendered with proper support and benefits, they aid in creating a niche for themselves in the competitive market.

Thus, with the view of encouraging more individuals to enter into entrepreneurship and for stabilizing their position in the market, the government has started a number of MSME Schemes for entrepreneurs in India, that delve through different areas of business. These schemes also aid in increasing productivity, building the competitive spirit amongst MSMEs, and assisting innovators.

[Before knowing about the various MSME Scheme provided by the Government of India. Check whether your business falls under the eligibility criteria of MSME. Read our article on What are the Eligibility Criteria for MSME Registration?]

Why are the schemes conceptualized?

These plans are conceptualized to bring the MSMEs under one roof to understand their needs and work for their betterment through benefits and incentives, women empowerment programmes, quality check at the source relegating rejection, offering credit provision, government subsidy schemes and much more.

MSME Schemes in India

Credit Link Capital Subsidy (CLCSS)

Anuj is an entrepreneur from Maharashtra, who has his food preservatives industry located in the interior region. His start-up is in the budding stage. As located in the interior regions of the state, there are very few amenities available for carrying on production. He wishes to upgrade his machinery and buy new ones for upscaling his production. However, pertaining to lower reach and diminished linkage with the market, he lacks sufficient resources for replacement. He came across the scheme of Credit Linked Capital Subsidy Scheme (CLCSS) and decided to avail for it.

By registering himself under this scheme, Anuj can now avail for a capital subsidy of 15 percent (Having a maximum cap of Rs. 15 Lakhs) of Machinery Value. In addition to important subsidies, he is also offered complete replacement of old technology with a new one. After having successfully upgraded his technology, his business functioned smoothly.

How is the scheme helpful?

- Upgradation of old technology – Thanks to Credit Linked Capital Subsidy, many Small-scale and Micro Industries are opportune to upgrade their technology and replace them with new ones so as to upscale their business. Considering the shortage of resources, buying new machinery remains a dream for many SSI, which eventually affects their profits leading to shut down.

- Enhanced Coverage – The scheme covers more than 7500 products falling under 51 sub-sectors.

Udyog Aadhar Scheme

Manohar wants to start a Micro-scale coir production industry. He requires a loan of 30 lakhs for setting up his plant and machinery. The bank offers him a loan of 30 lakhs at a 9% interest rate with collateral. On researching through government schemes for small businesses, he came across the Udyog Aadhar Scheme. Considering the immense benefits offered by Government, he registered himself under this scheme. He is thereby offered loan through financial institution and incentives that have aided him in facing the stiff market competition.

Benefits of Udhyog Aadhar Scheme

- Avail loans Collateral Free – Udyog Aadhar Registration that renders individuals with benefits and incentives for running their business as well as face the instability of the market. Individuals can garner collateral free loans with reduced interest rates

- Easy repayment – Registered entrepreneurs are not charged interest on late repayment with an extended repayment period of 15 years.

- Products are reserved that can be exclusively manufactured by MSME and SSI.

- Provision for upgrading technology – Being registered under this scheme, Manohar could avail for credit loans in future for advancing the machinery.

- Offered Barcode Registration Subsidy with 50% subsidy in registering for the patent

- Tax remission, Octroi benefits, waiver of stamp duty, concession on electricity bills and Excise remission.

[Udyog Aadhar will definitely help you to take your business forward in all aspects. To gain in-depth knowledge about Udyog Aadhar, read our article on “What is Udyog Aadhar & why should you register?“]

For Quality Check and Certification

Zero Defect, Zero Effect Scheme (ZED)

Manish runs an industry producing food preservatives. By registering himself under the MSME scheme he has been able to enjoy subsidies, incentives, and MSME tax benefits. He also exports his goods overseas in foreign countries. However, though his first consignment was accepted, his second consignment was sent back as it didn’t meet the expected quality check. He thus approached the MSME and asked for assistance. He was directed to register under ZED.

How is ZED beneficial?

MSMEs are potential sectors of the country who hold immense credibility for growth. Thus, the Government of India has ensured to offer complete support to the sector for their expansion, increase in participation, productivity and competition to withstand the changing market scenario.

For exclusively dealing and helping entrepreneurs like Manish, the MSME has flagged the scheme of Zero Defect, Zero Effect. On lines of this scheme, all the entrepreneurs who export their finished goods overseas can get a quality check done before export. With this scheme, the government deems to ensure high-quality production and zero rejection.

Benefits

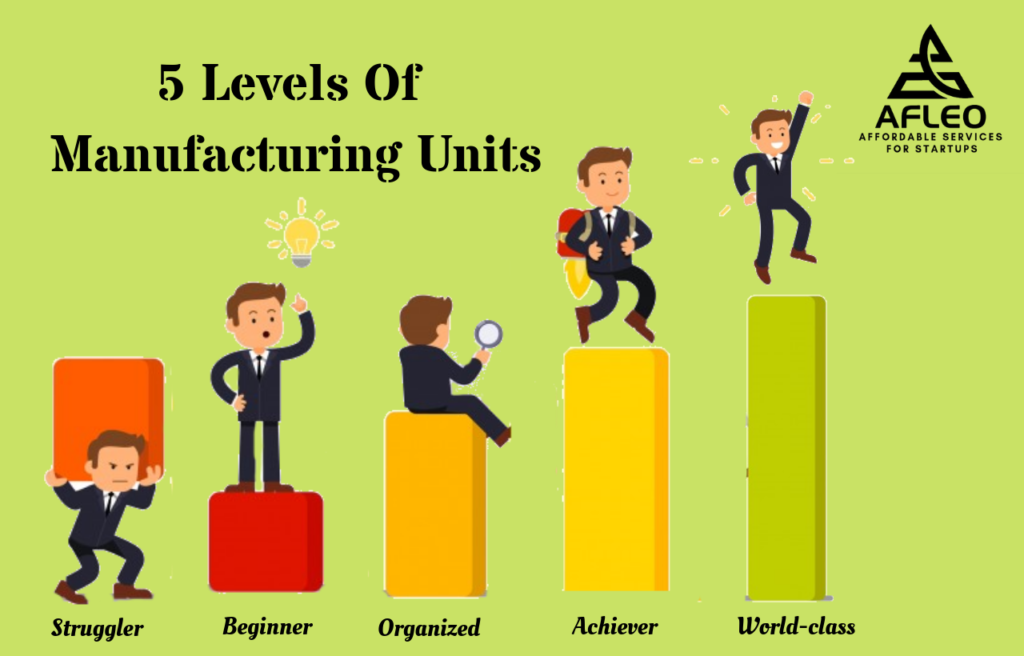

- The manufacturing unit will be assessed in 5 levels by Certification Bodies, and third-party accredited Credit Rating Agencies. The levels are as follows:

- The goods will be checked for quality, whether they meet the expected standards and for defects so as to prevent rejection.

- All the products checked through ZED scheme will carry the ZED Mark that ensures all the products have passed the quality check.

- Through ZED, MSMEs can gain credible recognition thereby increasing the potential of international investment by investors who wish to invest in India.

Quality Management Standards and Quality Technology Tools Scheme

Manish further registered in the QMS & QTT scheme to gain Quality check assistance before manufacturing. He is educated by experts regarding competitive pricing, ways to improve product quality, reduce rejection by proper check, proper use of inventory etc. This has enabled Manish in reducing wastage, understanding the market need in the Foreign and domestic market and implement tools for a better-quality check.

Why is the scheme started?

- Build awareness among MSMEs – The QMS & QTT schemes aids in building awareness about increasing productivity and implementing tools for reducing waste. MSMEs are tutored by conducting campaigns, workshops and much more.

- It reduces the rejection of products.

- Reduce inventory waste in different stages of product building

- Position MSME in the competitive market

- Gain insight into the latest foreign products

Certification Reimbursement Scheme

Manish holds a Permanent Registration Certificate and has acquired an ISO 9000/ISO14001/HACCP certification. He has registered for upgrading to ISO 14001 certification. Thus, he has availed a reimbursement of 60,000 for acquiring the certificate.

Purpose of the scheme

With the lieu of enhancing competitive strength of SSI, the government offers MSMEs registered under SSI or Udyog Aadhar reimbursement of up to 75% of expenditure cost when they upgrade to ISO14001 certification so as to withstand the global market competition.

For Start-ups and Innovators

Incubation Scheme

Arun is a student of IIT who has built a new technology for making instant perfect round Roti using a machine. He wants to take this project to next level and begin his start-up. However, being a student, he doesn’t have the required resources and the total project costs 7 lakhs. Hence, the institution has decided to host for his idea and explore it further by registering in the incubation scheme of MSME. Through the Incubation scheme, the institution is now provisioning Arun with the necessary technology gaining financial assistance from GOI.

With the assistance, Arun has been able to commercialize his project, gain linkages to market and expand his innovative design.

Benefits of Incubation scheme

- A valuable scheme for Start-ups – Innovators whether students or individual innovators are provisioned from GOI to explore their ideas and turn it into business. The innovators can avail for this through Host Institutions or through Business Incubator who act as representatives.

- Financial Assistance – Start-ups gain 75% to 85% of financial assistance for a project value of maximum 8 lakhs

- Links to market – Innovators like Arun are assisted in promoting and develop linkages for commercializing their product.

- Who can apply? – Start-ups, UGC approved Educational Institutions, Technical Centres, Development Institutes.

Women Entrepreneurship Scheme

Radhika wants to start a Computer Centre. She approached the Small Industries Development Bank of India (SIDBI) for a loan. Her total project cost is 8 lakhs. She is rendered soft loan of Rs.2,00,000 with services charge of 1% p.a under the Mahila Udhyam Nidhi as a part of Women Entrepreneurship scheme by MSME. She is also provided assistance through the Mahila Vikas Nidhi for the development of her business along with training assistance, counseling, and technology for setting up her business.

[Are you a woman entrepreneur looking for business loan schemes which can help you to start a business or expand an existing venture? Mudra Yojana Scheme is one of the Government Scheme to support entrepreneurs in India, read our article on How to get Pradhan Mantri Mudra Yojana (PMMY) Loan?]

Benefits of Women Entrepreneurship Scheme

Encourage Participation of Women in Business

Women play a major part in the development of the economy. Many SMEs are run by Women Entrepreneurs, who have achieved remarkable success in the field. With the increasing participation of women in businesses, the govt has initiated lucrative schemes which supports them and encourages them to expand their business.

Easy Generation of loan

The Mahila Udhyam Scheme previously known as Micro Credit Scheme offers equity to women entrepreneurs, granting soft loans with a repayment time frame extending 10 years. The entrepreneurs can avail a maximum of 10 lakhs as a loan, the interest based on market rates.

Technology and Training tools

Through both the schemes, women entrepreneurs are offered training assistance, upgrade of technology, inputs for production, counseling and much more.

[Hope you understood the various MSME Schemes in India. To know about the Benefits of MSME Registration, read our article on “What are the Benefits of MSME Registration in India?“]

How to register Under MSME?

Individuals who want to benefit from above given MSME schemes, registering your business under MSME is the first step. This can be done online as well as offline. Afleo offers MSME Registration facilities which renders assistance for industries and businesses in getting themselves registered and avail benefits from the various schemes. For any query, please feel free and get in touch with us.