At times, the recipient (buyer) of the goods or services makes the payment to the supplier (seller) before the supply of such goods or services which is known as the advance payment made. The advance payment under GST can be made in the form of cash or through cheque. Through this article, we will understand what will be the implications of GST on advance payment received by the supplier?

Time OF Supply

The GST liability is triggered at the time of supply. Hence, it becomes imperative to understand this concept. Because of this reason, we will first understand Section 12 and section 13 of the CGST Act, 2017 and later will look into the provisions of GST applicability on advances.

Section 12- Time of Supply of Goods

The GST liability on the supply of goods shall arise on the issue of invoice on advance received under GST or receipt of payment, whichever is earlier. Hence, even if the payment is received before the sale of goods or issue of invoice, the GST liability would arise on such advance payment.

Section 13- Time of Supply of Services

The GST liability on the supply of services shall arise on the issue of invoice or receipt of payment, whichever is earlier. Thus, it can be said that the provisions are similarly worded for goods and services. Hence, GST on advance payment would be applicable for the supply of services.

[Under GST, transporters should carry an eWay Bill when moving goods from one place to another when certain conditions are satisfied, to know more information read our article on E-way Bill GST]

Treatment of GST on Advance Payment

As per Notification No. 40/2017 of Central Tax (Rate) dated 13th October 2017, the provision relating to tax payment on advances for the supply of goods was relaxed w.e.f. 13th October 2017 for small businesses having a turnover less than Rs.1.5 crores in the last Financial Year.

However, as per Notification No. 66/2017 of Central Tax (Rate) dated 15th November 2017, the above-mentioned benefit has been extended to all the taxable persons making the supply of goods.

Thus, advance payment under GST made in respect of the supply of goods would not attract any GST liability. However, the liability of on the advance payments for supply of services would continue to exist.

GST Calculation on Advance Payment

Any advance payment made to the supplier shall be considered as an inclusive amount wherein the GST component is present together with the taxable value.

Let us understand this by an example.

Suppose Mr. A (of Mumbai) makes an advance payment of Rs.59000 to Mr. B (of Pune) for the provision of services and the GST rate applicable to such service is 18%.

In this case, Rs.59000 would be+ considered as an amount inclusive of GST and reverse calculation is required to be done in order to arrive at the actual advance amount and GST liability. The breakup of Rs.59000 would be as follows:

Accounting Entries for Advance Received

Now, we will understand the accounting entries to be passed in the books of the supplier, when the advance receipt under GST is received.

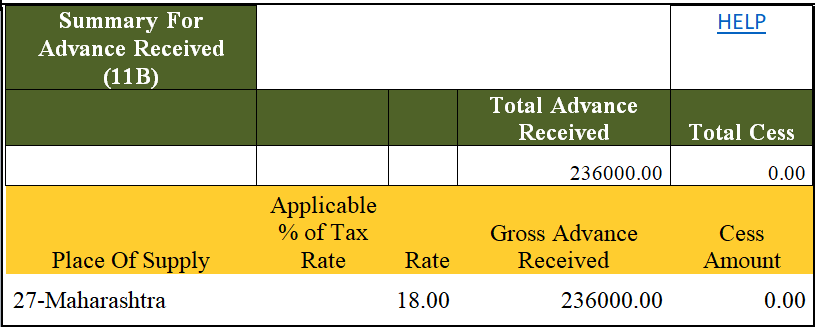

For Example, Mr. AB (of Mumbai) received an advance payment of Rs.236000/- from Mr. XY (of Pune) for the provision of services which is liable to 18% GST rate. The total invoice value is received in the form of advance payment. The advance is received in the month of August and the actual supply of services will be made in the month of September. The accounting entries (in the books of Mr. AB- supplier) at the different phases of this transaction are as follows:

-In the Month of AUGUST (Advance Received)

a) Advance Received from Mr. XY Rs.236000/- (Inclusive of GST @18%)

b) Creation of New Ledger & Entry for GST Payable on Advance Received

c) Making Payment of GST on Advance Received

-In the Month Of SEPTEMBER (Invoice Issued)

d) At the Time of Supply of Services (against which advance received earlier)

e) Adjustment Entry for taxes paid on Advance

Disclosure Requirement in GSTR1

– In the month in which Advance Payment Received

– In the month in which Invoice issued against such Advance Payment Received

[To modify GST Registration, you don’t require new GST Number to know more click on our article GST Modification]

Conclusion

The major relief is given to the supplier of goods by exempting the advance received for such goods from GST liability, however, the supplier of services are still required to adhere to provisions relating to payment of tax on advances.

As can be seen from the above-mentioned points, the compliance work would be increased due to GST applicability on advance payments. The registered tax person would be required to keep proper records of advances received so as to adjust the same while issuing relevant invoices; otherwise, the same amount would be taxed twice.

If you require more information or have any queries, Please fill below form to get in touch with us.