The Government of India has decided to continue the scheme for Rebate of State and Central Taxes and levies (RoSCTL) w.e.f. 01st January 2021 to 31st March 2024 for apparel/garments and Made-ups (Under Chapter 61 and 62 Chapter 63) in exclusion of RoDTEP for these Chapters.

As per the Advisory released from the Government following clarification has been done regarding the implementation of the RoSCTL Scheme.

Processing of RoSCTL Claim w.e.f. 01/10/2021

The following changes have been done related to the implementation of RoSCTL in systems and came in effect from 1st October 2021.

- Specific scheme code

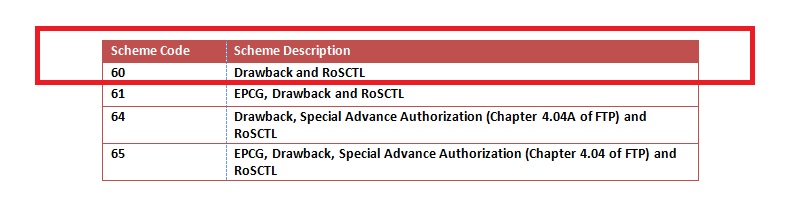

To avail of the benefits under the RoSCTL Scheme, the claim has to be made by the exporter in the EDI shipping bill by using specific scheme codes.

The options for the RoSCTL scheme are being provided with separate scheme-code as listed below –

- There is no need to file separate applications or supporting documents except for making a specific choice of scheme codes in shipping bills along with a declaration.

- In the absence of proper scheme codes, the RoSCTL benefit would not be available.

The exporter shall not be required to amend the existing shipping bill or file a separate claim.

Processing of shipping bills to claim RoSCTL benefits in which RoDTEP has been declared for chapter 61, 62, and 63 products:

- To avail of the benefits, scheme codes were discontinued under RoSCTL w.e.f. 01/01/2021 as per the CBIC instruction since the RoDTEP scheme was implemented w.e.f 01/01/2021.

- Thus Claim in shipping bills was disallowed instead RoDTEP was allowed to be claimed at the item level. The RoDTEP claim was allowed in addition to the Drawback. But now the Government has extended the RoSCTL policy till 31.03.2024 for chapters 61, 62, and 63.

- There is no need to amend the shipping bills to claim the benefits under the RoSCTL scheme in which the RodTEP and Drawback have been claimed at the item level.

- The RoSCTL amount would be calculated by the system for the relevant tariff items for chapters 61, 62, and 63 for cases only where both RoDTEP and Drawback were claimed at the item level.

- The RoSCTL benefits would not be given for the shipping bills where RoDTEP was not claimed only drawback was claimed.

- Similarly, the benefits under RoSCTL would not be given where RoDTEP was claimed at item level but the drawback was not claimed.

Calculation of Benefits:-

- The RoSCTL benefits would be calculated on a value equal to the FOB value of the goods or up to 1.5 times the market price of the said goods (Whichever is less).

Get in touch with us for more clarification on How to proceed for availing the benefits under the RoSCTL scheme for chapters 61, 62, or 63 where the RoDTEP scheme has been declared in the shipping bills from 01/01/2021 to 30/09/2021.