The SEIS Scheme (Service Export from India Scheme) was introduced under foreign trade policy 2015-2020 to provide the incentive of 3% to 7% on net foreign exchange earned in the form of duty credit scrip. The objective of introducing the SEIS Scheme is to promote the export of notified services in the international market. Service providers of notified Services, as per appendix 3D, are only eligible to avail the benefits under SEIS Scheme.

The Government had suspended the issuance of benefits under various export incentive schemes including the SEIS Scheme due to the allocation procedure.

[Watch this short video on the SEIS Scheme for 2019-2020 which explains Eligible services for the benefits under SEIS Scheme, benefit rates, and procedure to avail the benefits for FY 2019-2020.]

SEIS Scheme for FY 2019-2020

The service industry has been impacted much during the pandemic and to provide some relief to the service exporters the Government of India notified the benefits under the SEIS scheme to be given for the exports undertaken in FY 2019-20.

On September 9, 2021, The Government of India has decided to release Rs. ₹ 56,027 to provide stuck benefits under incentive schemes. For SEIS Scheme Rs 10,002 Cr has been allocated for FY 2018-19 and 2019-20.

As per Notification No. 29/2015-2020, 23rd September 2021 the SEIS scheme for the FY 2019-20 has been notified. There are various services that have been excluded from the eligible list of services for the benefits and also benefit rates have been reduced for some.

In this article, we are going to discuss the SEIS Scheme for FY 2019-20.

List of the services excluded from the benefits under FY 2019-2020

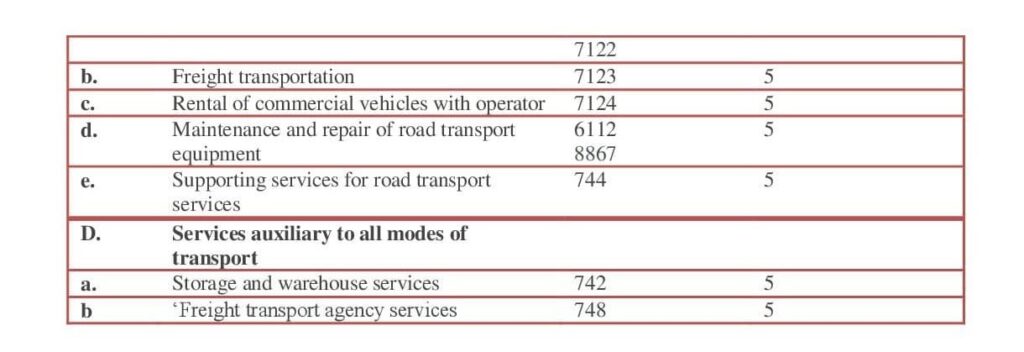

The following list of services has been removed from the list of notified services eligible for FY 2019-2020 under the SEIS Scheme.

Reduction in benefit rates

The incentive rate under the SEIS scheme for FY 2019-2020 has been notified in the range of 3% to 5% on net foreign exchange earned which was earlier 5% to 7% on net foreign exchange earned. The benefit rate would be reduced by 2% as compared to the previous year’s rate.

List of the eligible services under SEIS Scheme for FY 2019-2020

Refer to the below list which is notified for FY 2019-2020 with the benefit rates of 3% to 5% –

To avail the benefits under the SEIS Scheme Error-free Documentation is the important part, prepare the below list of documents well in advance before proceeding with the application –

Documents Required for SEIS Application for FY 2019-20

List of documents required for the SEIS Scheme

- Importer Exporter Code (IEC Code)

- Application form ANF-3B (Aayat Niryat Form)

- CA Certificate

- Statement showing the nexus between Invoices and FIRC’s (Table No 4)

- Write up of Services

- Self-Certified copy of invoice and FIRC’s

- DGFT Digital Signature Certificate (DSC)

- RCMC Copy

- Necessary Declarations

Procedure to avail the benefits under SEIS Scheme for FY 2019-2020

As per DGFT Notification, the SEIS scheme for the FY 2019-20 has been notified. Important points before proceeding for the application under SEIS Scheme

- Total Entitlement is capped per IEC at Rs. 5 Cr for FY 2019-2020.

- To avail of the benefits under the SEIS Scheme for FY 2019-2020 online application has to be done on DGFT Portal as per ANF 3B by 31.12.2021.

- There will be no provision for the Late cut.

- The application under SEIS Scheme shall get time-barred after 31.12.2021.

Step 1 : – Visit DGFT Portal – https://www.dgft.gov.in/CP/

Step 2: – Select SEIS Scheme from the Services tab and do the login in DGFT Portal.

Step 3:– Login with valid credentials and start a fresh application.

Step 4:– The below screen will appear for online application under SEIS Scheme for FY 2019-2020.

Step 5:– There would be 7 tabs on the online application screen –

Applicant details – The first tab is applicant details, in this section Applicant’s name, IEC number, Company name, company address would be auto-populated. Few details are required to be filled in by the applicant.

RCMC – The valid copy of RCMC (Registration Cum Membership Certificate) is required to apply for SEIS benefits.

Net foreign exchange details – All the invoice details have to be filled from 1st April 2019 to 31st March 2020.

All the other details have to be filled in; the required attachment has to be done before submitting the application.

Accept the terms and conditions on the declaration page, pay the Government fee and submit the application.

[To know the complete procedure to avail the benefits under SEIS Scheme in details visit on – SEIS Scheme (Service Export from India Scheme)]

How can we assist you in claiming benefits under SEIS Scheme from DGFT?

We at Afleo Consultants are India’s leading Import-Export Consultants, having rich experience of 10+ Years in the same domain. We specialize in all the DGFT and Customs-related matters – Export incentive schemes such as RoDTEP, MEIS, SEIS, Import authorizations such as advance License, EPCG, Status Certification AEO/Star Export House certification, Duty Drawback, etc.

Our experts would perform the following tasks for you under SEIS Scheme –

- We conduct Extensive Consultation with our Clients to understand the nature of their services and to determine whether they will be eligible to claim or not.

- We assist our clients in the preparation of documents in providing hassle-free services.

- Prepare and submit online applications to obtain the License under the SEIS scheme.

- Dedicated team for Follow-up at the DGFT Department for speedy processing of SEIS.

- Registration of the License is done in customs from our office.

- We also assist in the selling of licenses at the best available rate, provide help in documentation for the transfer of a license to the buyer.

- Also, do the online transfer by recording the details on the DGFT website.

- We complete the entire process in a time-bound manner.

[Not sure whether your company is taking all the Export incentives notified by the Govt? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India“]

We have a PAN India presence.

We would appreciate your comments and views on the above topic.