What is EPCG Scheme?

Export Promotion Capital Goods (EPCG) scheme was introduced to allow duty-free import of capital goods/machinery for pre-production, production, and post-production of export goods. It is a boon to exporters since they don’t have to pay a big amount of customs duty on the imported capital goods.

The best quality of goods and services can be provided with the best technology availability under EPCG Scheme. The lower cost of capital goods makes the manufactured goods cost-competitive in International Market.

How Afleo Consultants can be a one-stop solution for all EPCG related matters?

Afleo Consultants is committed to helping exporters and importers to manage and grow their export business in the international market with peace of mind at an affordable price. Our aim is to educate them for each step from issuance of EPCG license to the redemption of License at DGFT and Customs and be a partner throughout the entire Importing-Exporting process, offering support to the company at every stage to make sure they are compliant and continually growing.

To whom we are providing the EPCG services

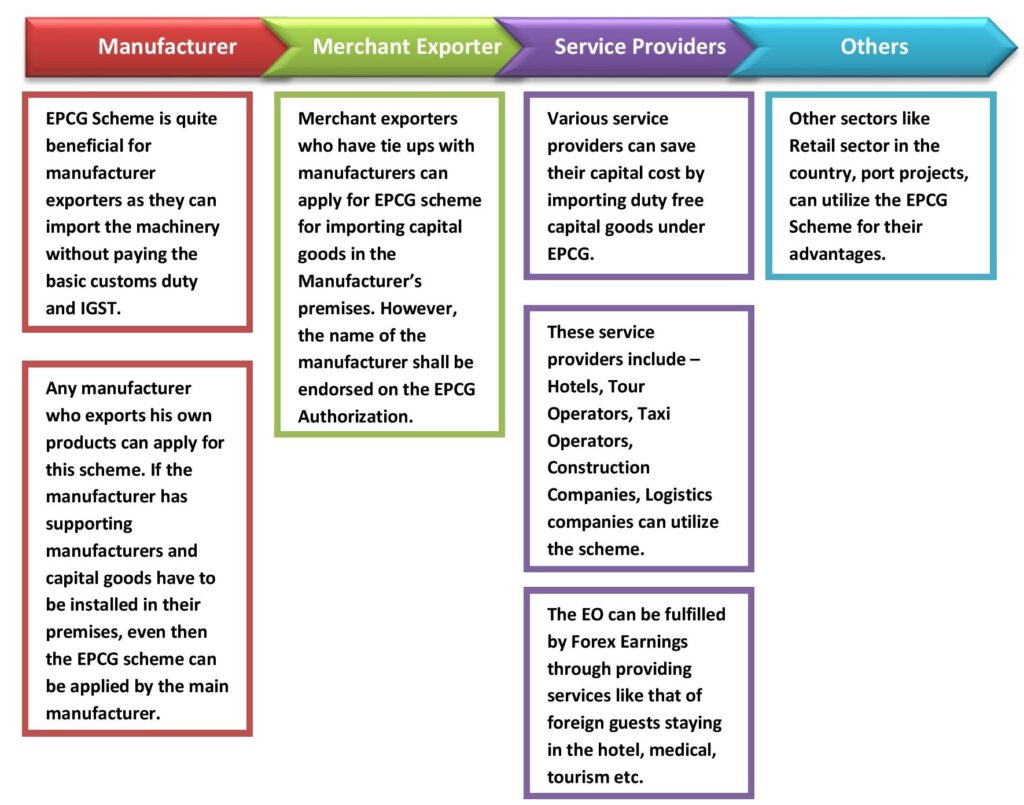

We are serving Manufacturer Exporters, Merchant exporters tied with supporting manufacturers, service providers such as hotels, tour operators, logistics service providers, etc., and various other sectors which are eligible to get the benefits under the EPCG scheme.

(Refer to the image below to find out in which category you fit into to get the EPCG License.)

Watch this short introductory video on the EPCG Scheme; which explains the complex concept of EPCG in an easy-to-understand manner. It Explains What is EPCG Scheme and its application process; details about Export obligation & Redemption of EPCG License; the entire summary and step-by-step procedures involved in the EPCG scheme.

Procedure to avail the benefits under EPCG Scheme and our role at each stage?

Please find the below steps involved under EPCG Scheme and our role at each stage

Issuance of EPCG License from DGFT

EPCG license issuance procedure is a difficult process, without proper guidance the whole process gets complex. Maintenance of Average Export Obligation (AEO) is a major problem in EPCG Cases which we come across regularly. Therefore If the Company is sure to achieve stable export orders in the years to come, then the EPCG Scheme is a very good option for them.

At Afleo we make sure that the client is aware of the terms and conditions of the scheme with respect to an export obligation. It is very essential that the EPCG application is filled with consequences in mind.

Registration of EPCG License at Customs

After issuance of the license, it has to be registered with the port of import at the relevant customs. The customs ask for the execution of a Bond to safeguard their interests if the export is not made within the given time period as per the license. In some cases, they also ask to give a bank guarantee (BG) as additional security.

We assist our client to get the registration done at the port as soon as the license is issued by DGFT.

We do the proper follow-up, representation on behalf of the company to the DGFT to get the license issued.

Import of Capital goods/Machinery duty-free under EPCG Scheme

After the registration of the EPCG License, Capital goods should be imported within 12 months from the EPCG license issuance date. Revalidation of the License under EPCG would not be permitted.

We provide guidance to our client on what precautionary measures have to be taken care of while filing the bill of entry at the time of import and make sure that the client clears the capital goods without paying the duty from the customs.

Installation of Capital goods

After the machinery is imported, the installation has to be done in the factory or project site, here at Afleo we make sure that the factory premises/address where the machine is going to be installed has to be declared in EPCG License which is the important part of the application.

What is the installation Certificate and from where to obtain it?

- Installation Certificate certifies that the capital good is installed on the factory premises at this date and it is functional now and can be used in the production of export goods.

- It can be obtained from an independent Chartered Engineer (CE) once the installation is done.

- The installation Certificate has to be submitted to DGFT within 6 months from the import date. Non-submission can lead to penalties.

- We also assist to get the extension in the submission of the installation certificate by a maximum of 12 months with the penalty of Rs 5000/- from DGFT (One-time extension is allowed by DGFT)

Exports of Goods and Services

Under the EPCG Scheme, the licenses issued have to be monitored over a six-year period for the completion of export obligation.

During the export obligation period goods are produced and exported under EPCG License. During this period it is very essential to take care of proper export documentation so that the shipping bills are counted for the export obligations.

We provide guidance on what has to be mentioned in the shipping bills under EPCG to make it count for EO.

Redemption/Closure of License from DGFT

Redemption of License is a significant part of the EPCG Scheme and closing it at DGFT is a complex task.We assist you in filing an online application on the DGFT portal, preparing all the export documents and realization documents in the proper format, and attaching them along with the online application to redeem the EPCG License and get the Export Obligation Discharge Certificate (EODC). In case the export obligation is not completed within the given period we request the authority to get the extension in the Export Obligation period.

BG/Bond Cancellation at Customs

The BG/Bond cancellation at Customs is the last procedure under the EPCG scheme. Once the Export Obligation is completed and EODC is received from DGFT the license holder needs to approach the customs with required documents for the BG/Bond Cancellation.We are making sure that your Bank Guarantee (BG)/Bond is canceled by submitting all required documents to customs for the cancellation and doing rigorous follow-up with customs.

[Do you have EPCG License which has to be redeemed? visit our page to know the complete procedure of License redemption under EPCG Scheme – EPCG License Closure Procedure | EPCG Redemption – Complete Guide]

How do we offer Quality and Affordable Services related to DGFT matters?

Afleo has been assisting clients with the whole process of EPCG for more than 10 years. Sound knowledge of foreign trade policy & procedures along with qualified and experienced DGFT professionals, Afleo has handled hundreds of complicated EPCG scheme cases, saving hundreds of crores for clients that are MNCs, Indian Corporates, or PSUs. While proper planning during the entire EPCG Procedure has helped smooth operations, several complicated matters even at the last stage have been saved by the Afleo team.

Apart from the above standard procedure, we also guide our clients for:

- Modification/Amendment in EPCG License. [For Example addition of export products or services]

- Invalidation/Certificate of supplies for EPCG Authorisation.

- Clubbing of EPCG Authorisation.

- Submission of Installation Certificate to DGFT.

- Application for EOP Extension/Block-wise Extension.

- Handling/Submission of EPCG Committee cases.

We have our expertise in handling complex EPCG Redemption/Closure cases. Our team has closed 50 to 100 open EPCG Licenses (at a time) of many companies across India.