The Government of India had launched the Advance Authorisation Scheme (AAS) under the Foreign Trade Policy to allow the duty-free import of inputs required to manufacture the export goods. The Advance License benefits can be availed by the Manufacturer exporter or a Merchant exporter tied with a supporting manufacturer. Application for getting an Advance Authorisation must be made electronically on the DGFT website with the help of a digital signature.

In this article, we will explain to you “How to apply for an Advance License online” on the DGFT website with step by step details.

How to apply for Advance Authorisation online – Step by Step Guide

To start the online application for an advance license it is important to have three mandatory things in hand:

- DGFT Digital Signature Certificate (DSC).

- Registration-cum-membership Certificate (RCMC).

- SSI/MSME or any other manufacturing proof.

Application has to be submitted online on the DGFT website, manual application is not permitted under Advance Authorisation Scheme.

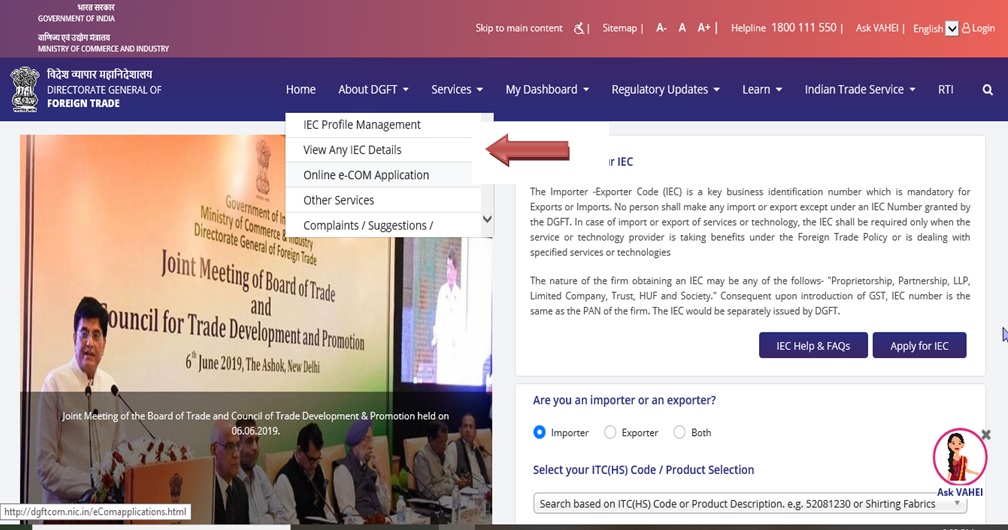

Step 1 – Visit the DGFT website

- Visit the Government website for DGFT – https://www.dgft.gov.in/CP/

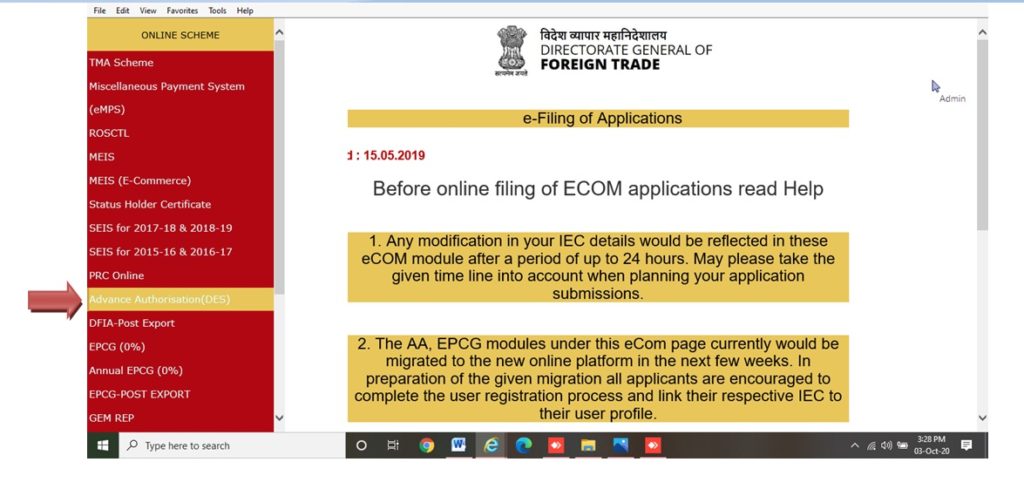

Click on “Online Ecom Application” under the services tab. - Please find the image for your reference below:

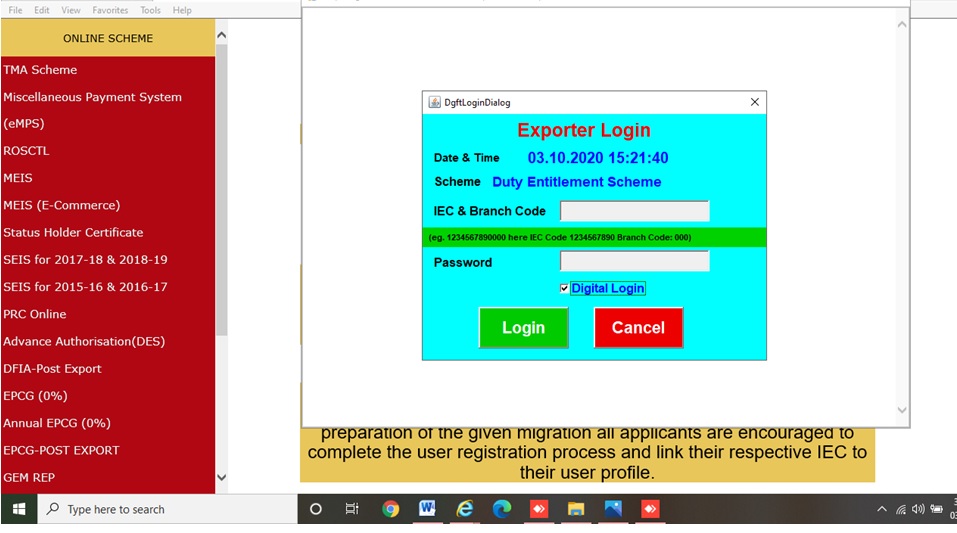

Step 2 – Login on DGFT Website

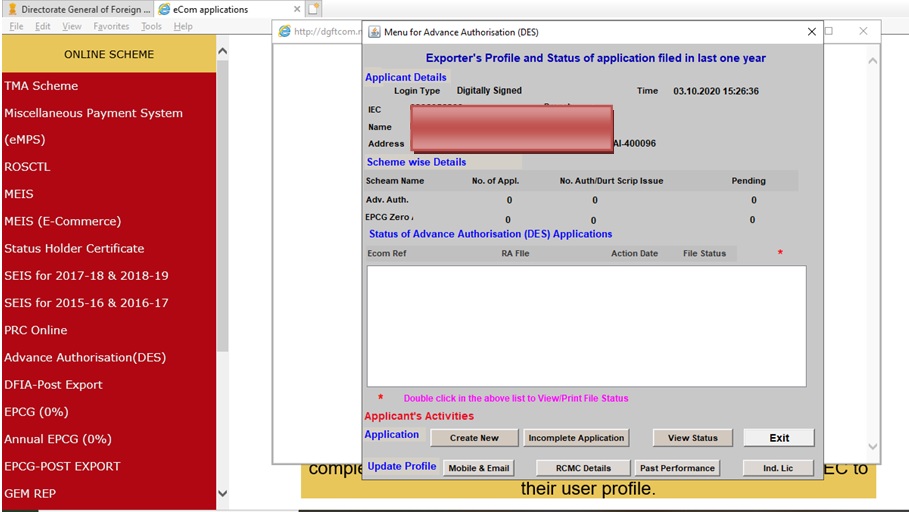

- After clicking on the Ecom Application below image will appear on the screen.

- Select Advance Authorisation Scheme (DES) option from the left panel and do the login process with Digital signature by entering the required credentials –

Step 3 – Create a New File

- After login with DSC, a new window will open.

The opened window will show the profile of the exporter along with the Advance/EPCG Licenses filed in the last year. - For the new application under Advance Authorisation Scheme select the “Create New” tab which will open a new Advance License application window along with the new file number.

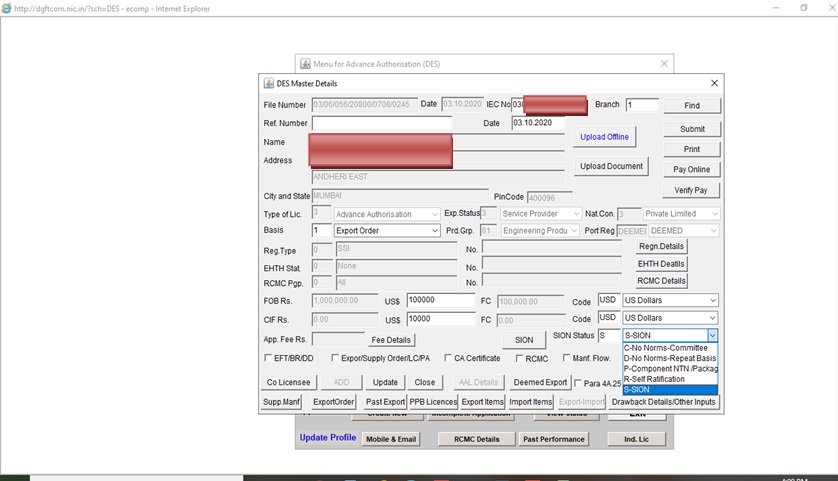

Step 4 – Fill out the mandatory details

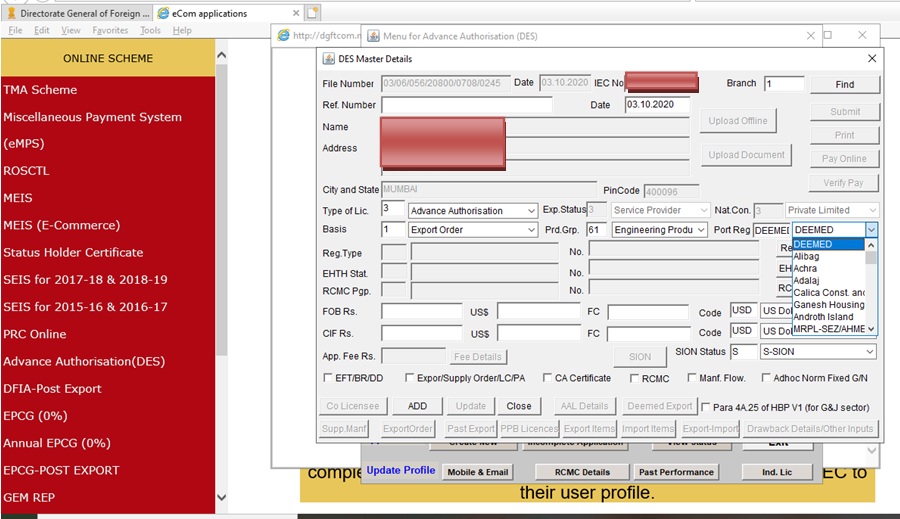

After clicking on the “Create New” tab, the main screen for the Advance License application would appear as follows:

- Import-Export Code Number, Name of the firm, Address of the IEC is pre-filled in the application window.

- Select the Port and choose the right name of the port where the inputs are to be imported. For Example – Nhava Sheva, Mundra, Bombay Air Cargo, Chennai Sea Port, etc.

- The name of the port needs to be filled correctly as it can’t be changed further.

- Select the type of exporter you are and the product Group Code from the drop-down list.

- Fill up the CIF in Rs which is the cost of the Imported inputs required to manufacture the export products, in Foreign Currency and US Dollars also.

- Click on the “Update” tab at the bottom of the window which will update the application form and save the details-filled.

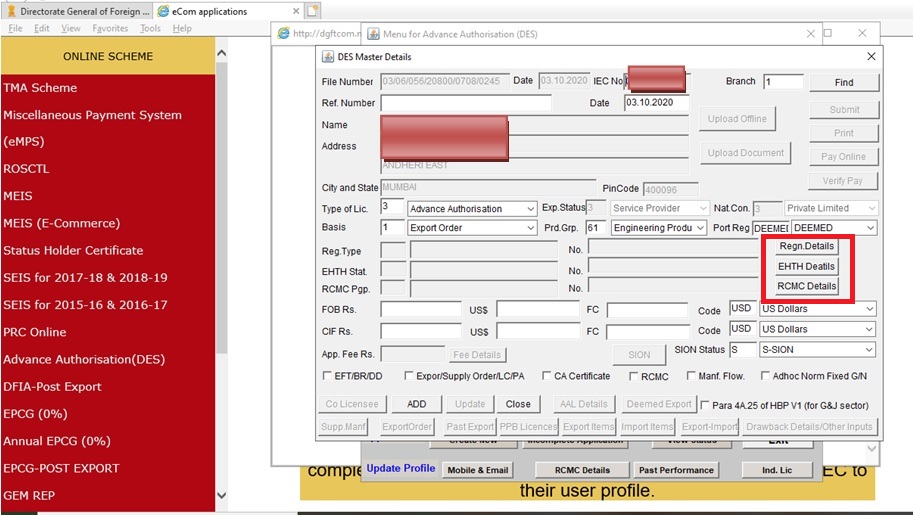

Step 5 – Fill out other details such as Industrial Registration, RCMC, Export House

- Advance License is issued with an actual user condition to a manufacturer exporter or Merchant exporter tied with supporting Manufacturer. Therefore details of manufacturing such as SSI, MSME, Industrial License, Industrial Entrepreneurs Memorandum (IEM), etc. need to be filled.

- If the firm has the Certificate of Status Holder or Export House, Click the “EH/TH” option and enter the required details. If you don’t have the Certificate ignore the option.

- Click on “RCMC Details” and enter details like the Registration no. Given by the export promotion council (EPC) for the membership, Issuance Date, Issuing Authority, Validity, products for which it is registered. Make sure the RCMC is valid.

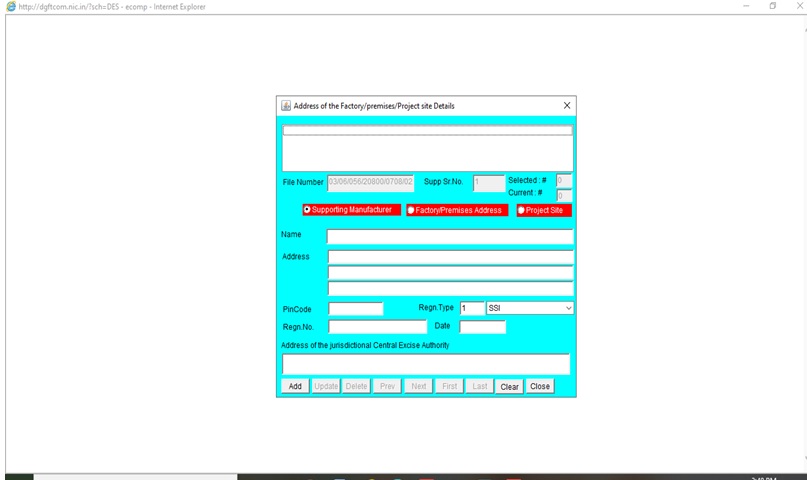

Step 6 – Fill in the factory Address

Below Screen will appear after clicking on the “Factory Add” from the main page of Application

- The file number will already be there updated by the system, fill up the other details such as Name of the Firm, Address and Pin Code of the firm. The factory address should not mismatch with the factory address given in Manufacturing License and should be the address where the raw materials will be processed.

- Choose Registration Type from the drop-down list.

- Click the Add button to update.

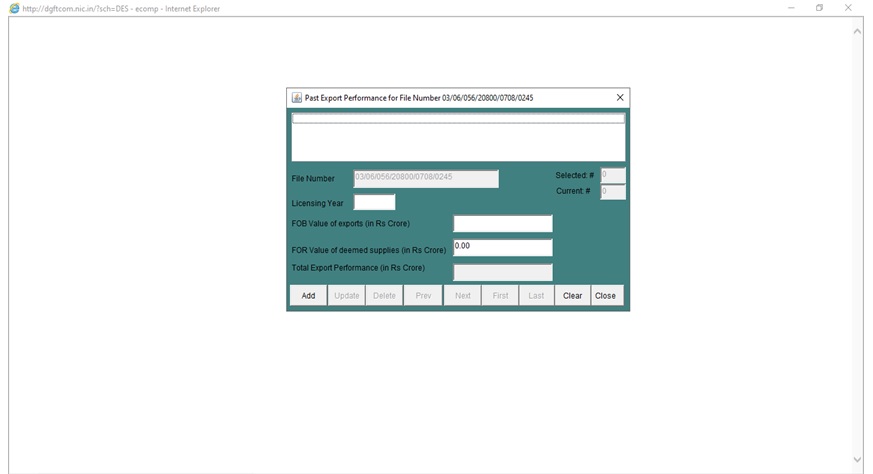

Step 7 – Fill Past Export Performance

Past Export performance is necessary to determine the maximum entitlement under the Advance License Scheme.

Details to be entered in this section:

- Enter the preceding three licensing year’s FOB & FOR value of exports.

Step 8 – Selection of Application method

There are four methods of the application under Advance License 1) SION 2 ) Self Declaration 3 ) Applicant specific prior fixation of norms 4 ) Self ratification.Select the application method correctly because it decides the further steps taken to get the license.

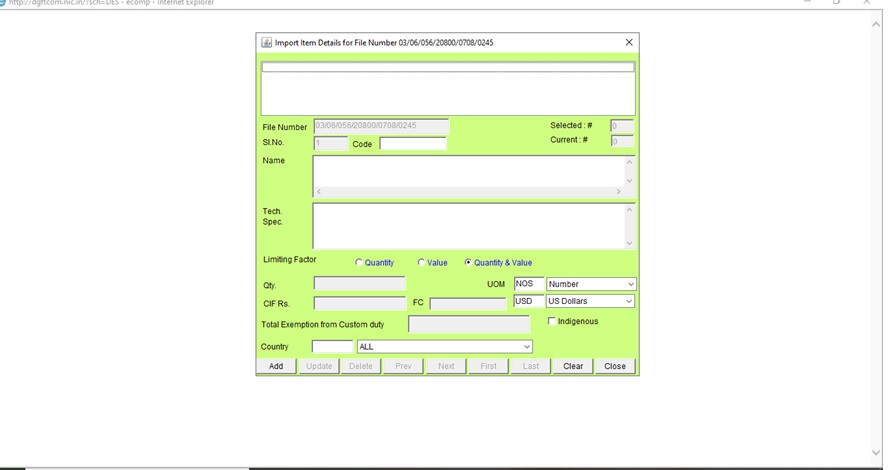

Step 9 – Fill in the Details of “inputs” to be imported

This is a very important section of the online application procedure. Here you need to fill in the details of raw materials and inputs required to be imported to manufacture the export goods.

- Enter the Item Name & HS Code. Double-check the HSN Code.

- Enter the Technical Specification if any.

- Enter the total quantity of inputs to be imported.

- Select the UOM accurately.

- Enter the Duty saved value in Rs., CIF value in Foreign Currency

- Enter the Country from which inputs are imported.

- Select the Add button for updating.

Details of Import item provided in the dialogue box should match with the Purchase order otherwise it will create a big problem in the clearing of inputs at the port under the Advance Authorisation Scheme. The total exemption from customs duty mentioned here will automatically be captured on the main dialogue box.

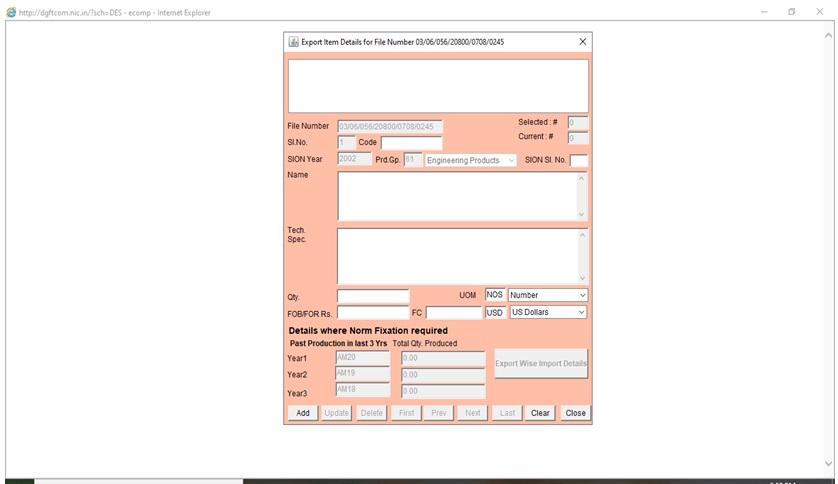

Step 10 – Fill up the export item details

Similar to Import details, Fill the Export item details like name & HS code; Quantity, FOB value, etc. After filling in all the details, add and update the application.

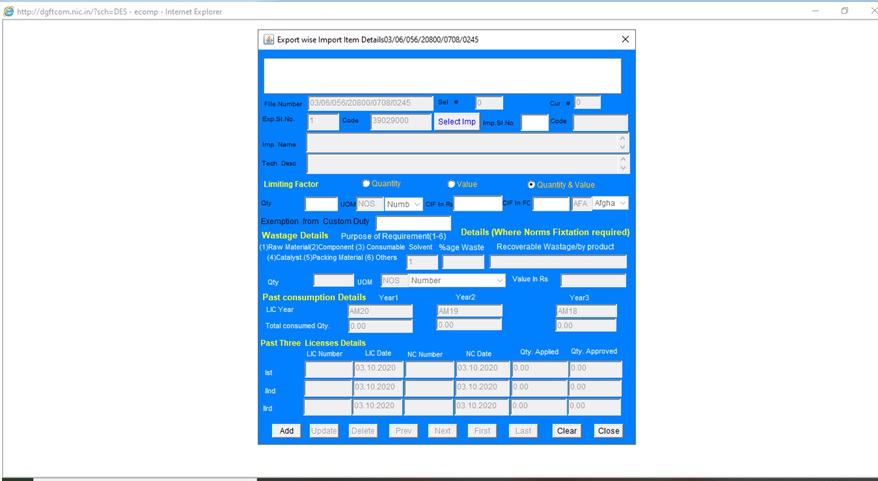

Step 11 – Export wise Import Item details

After filling in the details of import and export items. In the below screen you need to give the details of import items required to manufacture one unit of the export product.

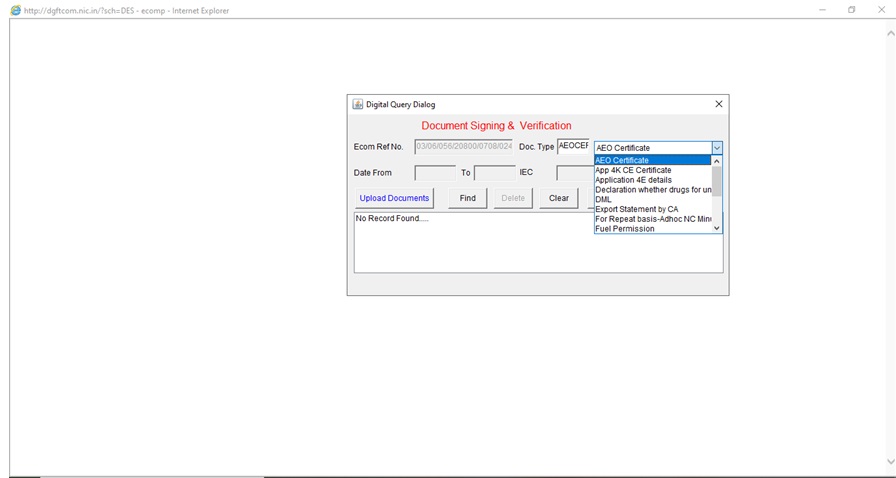

Step 12 – Uploading the Documents Online

The below screen will appear after selecting the “Upload Documents” tab on the main dialogue box.

Please find the image below for the reference:-

- In the online application, uploading the scanned copy of the documents is mandatory,

- For the Advance License, you need to upload the Application form, Export statement, and the required declaration.

- We have filled in the details required & also uploaded the necessary documents required for the Advance License Application Online.

- The application process will be completed in the next two steps and you can submit the Advance license Online application form to DGFT.

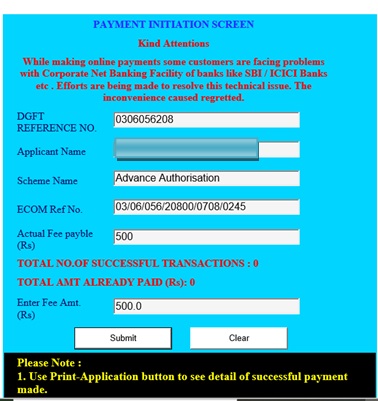

Step 13 – Online Payment

- Do the payment using a preferable mode of Payment,

- The advance License application will be rejected if the mandatory fee is not paid

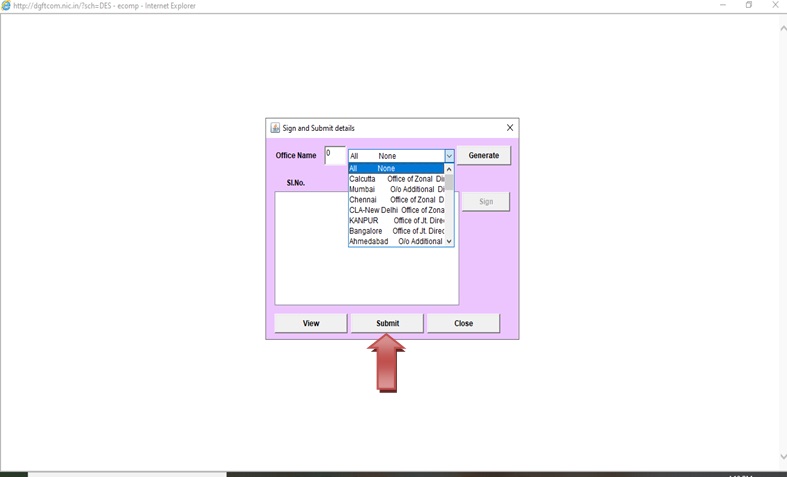

Step 14 – Submit the Application

Submit the Advance License application to the relevant DGFT office after selecting it from the drop-down menu.

See the image below for the reference –

The process for the Advance License online application is completed here.

Please contact the DGFT office to know about the application status after submission.

We hope that the procedure for “How to apply for Advance License Online” is now clear.

How Afleo Consultant can help you?

Afleo Consultants can help you with the Application as well as the closure of the Advance License with DGFT & Customs. With more than 10+ Years of experience, we can also guide you with all the procedures related to the Advance Authorization Scheme.

We are the leading Import Export Consultant (DGFT Consultant) having a client-base across India. We provide all the services related to DGFT which includes the MEIS scheme, EPCG, SEIS, Advance Authorisation, DFIA, RoSCTL scheme, TMA scheme, RoDTEP scheme, etc.

Please share your thoughts about the article in the comments section below.

Fill the below form and get in contact with us for more details.