What do Export promotion schemes mean & Why are they important?

As you all know that Exports play a major role in the economic development of a country. More the exports more will be the inward foreign remittance, more jobs & employment, lower current account deficit, and hence greater overall economic growth. Therefore, India needs to increase its export performance to grow quickly.

India is still a developing country. China’s total exports are roughly 8 times that of India. In spite of being one of the world’s largest countries, India is still ranking on the 18th position in the list of top exporting countries worldwide in 2019. Even a small country like Singapore is ahead of India.

So where is India going wrong?

One of the major reasons for India’s poor export performance is its high cost of export products. Indian exporters are not able to sell the goods at a cheaper and competitive rate, which makes them uncompetitive in the global market resulting in loss of orders.

So why do Indian products have high prices? There are many reasons:

- Poor Infrastructure– This increases the cost of doing business in India. For example, it is cheaper & faster to move a container by ship from Malaysia to Chennai than it is to move the same container from Chennai to Mumbai by road/rail.

- Associated Costs– Rail freight rates for the Export Industry are one of the highest as compared to other countries. Also, Industrial electricity rates in India are very high. The high cost of land for setting up industries is another major factor leading to an increase in prices.

- Cost of credit– Due to high inflation, the interest rates in India have remained high for a very long period.

All the above factors lead to an increase in the cost of export goods as compared to other countries. Therefore, the Govt. of India tries to compensate for the disadvantages that the Indian exporters face by introducing various Export Promotion Schemes/Export Incentives in India.

Hence for better export pricing and to remain competitive in the global market it becomes extremely important to have complete knowledge about all the export promotion schemes/export benefits in India and make full use of them.

18 Must-Know Export Incentives in India if you are an Exporter

In this article, we are going to cover 18 latest & major export promotion schemes in detail. The benefit under more than one export promotion scheme/export incentive schemes can be taken for a particular shipment (with some exceptions). So study all the schemes and analyze your eligibility to avail export benefits in India.

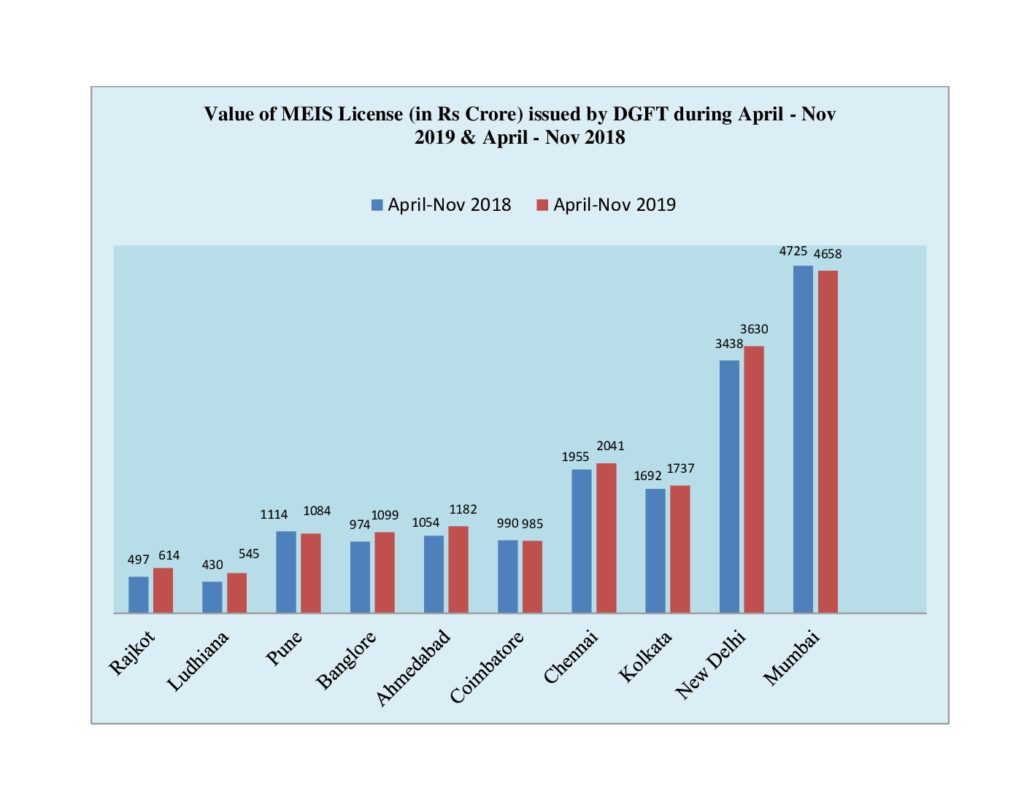

Merchandise Exports from India Scheme (MEIS Scheme)

- The objective of the Merchandise Exports from India Scheme (MEIS) is to promote the manufacture and export of notified goods/products from India.

- Funds Allocated – 40,000 Cr. Annually (Approx)

- Under the MEIS Scheme, an incentive of 2% to 5% of the FOB value of exports is provided to all the exporters (merchant as well as manufacturer exporter), irrespective of their annual turnover.

- The export of products notified/listed in Appendix 3B is only eligible for MEIS benefits.

- There are more than 8000+ products that are eligible.

- There is no restriction of Country, i.e. eligible products exported to any country in the world can avail the MEIS Scheme.

- MEIS rate of incentives differs from product to product.

- Application for MEIS scheme is to be filed electronically to the jurisdictional DGFT office

- MEIS incentives are not given in the form of cash or Bank transfer. It is given in the form of duty credit scrips also known as MEIS licenses. These licenses can be used for payment of Import duties or can be sold in the open market at a discounted rate.

- MEIS is soon to be replaced with the new RoDTEP Scheme. However, shipments till December 2020 or March 2021 can still claim MEIS benefits.

[To know more about the application process & documents required for MEIS Scheme, you may refer our article here – MEIS Scheme]

Rebate of Duties & Taxes on Export Products (RoDTEP Scheme)

- The new RoDTEP Scheme will replace the old MEIS Scheme in a phased manner from December 2020.

- The new scheme was necessary as the old MEIS Scheme was not WTO-compliant. It was against the International Trade rules.

- The RoDTEP scheme aims to refund all those hidden taxes and levies, which were earlier not refunded under any export incentive scheme, For example:

- Central & state taxes on the fuel (Petrol, Diesel, CNG, PNG, and coal cess, etc) used for transportation of export products.

- The duty levied by the state on electricity used for manufacturing.

- Mandi tax levied by APMCs.

- Toll tax & stamp duty on the import-export documentation. Etc.

- The entire application process will more or less remain the same as the MEIS Scheme, however, some changes in the rate of incentives are expected.

- The List of eligible products & the rate of benefit under the new RoDTEP Scheme is still not finalized.

Am I eligible for this scheme? – Yes, once the MEIS Scheme is stopped by the Govt. Thereafter, eligible exporters can apply under the new RoDTEP Scheme.

Watch this short video on RoDTEP Scheme which explains What are the duties & taxes going to be refunded? When is it going to be applicable? Who all are eligible to claim? Its application process & finally how can we at Afleo Consultants help you in getting your RoDTEP benefits from the Govt.

Service Export from India Scheme (SEIS Scheme)

- The objective of Service Exports from India Scheme (SEIS) is to encourage and maximize export of notified Services from India.

- Service Exports also provides valuable foreign exchange to the country, therefore there is a need to motivate service exporters as well.

- Under the SEIS Scheme, an incentive of 3% to 7% of Net foreign exchange earnings is provided to services exporters of notified services in India.

- It requires the service providers to have an active Import-Export Code (IEC Code) with minimum net foreign exchange earnings of 15,000 USD to be eligible to claim under the scheme.

- Services listed in Appendix 3D are only eligible to claim the rewards.

- Similar to the MEIS scheme, rewards under the SEIS Scheme are given in the form of freely transferable duty credit scrips.

- An application under the SEIS scheme is to be filed electronically to the jurisdictional DGFT office

Am I eligible for this scheme? – Yes, if the service which you are exporting is covered by Appendix 3D, then you can apply for the SEIS scheme, provided you have an active Import-Export Code.

[To know more about the list of eligible services, ineligible categories & documents required for SEIS Scheme, you may refer our article here – SEIS Scheme]

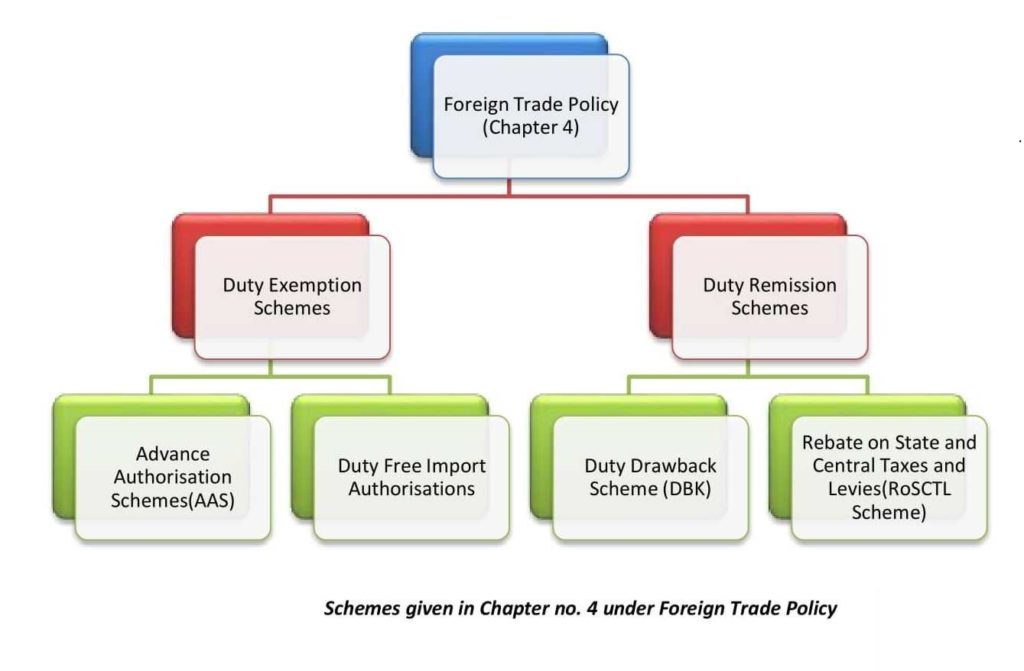

The next set of Export benefits in India includes the Duty Exemption & Duty Remission Schemes. The objective of these schemes is to enable duty-free import of inputs for export production, including replenishment of inputs or duty remission.

As the given figure above the Duty Exemption schemes consist of the following schemes:

- Advance Authorisation Scheme (AAS) (which will include Advance Authorisation for Annual Requirement).

- Duty-Free Import Authorisation (DFIA Scheme).

Whereas, The Duty Remission schemes consist of:

- Duty Drawback (DBK) Scheme, administered & implemented by the Department of Revenue.

- Scheme for Rebate on State and Central Taxes and Levies (RoSCTL Scheme), notified by the Ministry of Textiles on 07.03.2019, and implemented by the DGFT Office.

Let us understand Duty Exemption & Duty Remission Schemes in detail.

Advance Authorisation Scheme (AAS)

- Advance License scheme was introduced to allow duty-free import of raw materials required for the production of export goods.

- It means that one can import raw materials at 0% Import duty if those raw materials are going to be used in the manufacture of the export products.

- An Advance License can be issued for physical export (including supply to SEZ) & Deemed Exports as well (For Ex. Supply to EOU units or supply to any AA/EPCG holder)

- Advance License comes with an obligation to maintain a minimum of 15% value addition and to export the goods within 18 months from the License issue date.

- The materials imported under the Advance Authorisation Scheme comes with “Actual User condition”. i.e. It cannot be transferred or sold to any other entity.

- This scheme is implemented by the DGFT office.

Am I eligible for this scheme?

- You are a manufacturer Exporter and you use a majority of Imported raw material as compared to local raw materials for production? – YES/NO.

- You are a manufacturer Exporter and using domestic raw materials, but your raw material is made by a domestic supplier using a majority of imported materials? – YES/NO.

- You are a merchant Exporter, but your export product is made by your supporting manufacturer using a majority of Imported raw material as compared to local raw materials? – YES/NO

- You are a domestic manufacturer and supplying finished goods to SEZ or EOU Unit or any Advance Authorisation holder using imported raw materials? – YES/NO.

If your answer to any of the above questions is YES, then the Advance Authorisation Scheme may be beneficial for you.

Watch this short video on the Advance Authorisation Scheme which explains How does the scheme work? Who all are eligible to claim, its application process, export obligation & EODC/Redemption procedures & finally how can we at Afleo Consultants help you in getting Advance License benefits from the Govt.

[To know more about the various types of Advance authorization, Advance license scheme procedure & documents required for applying, you may refer our article here – Advance Authorisation Scheme]

Duty-free Import Authorisation (DFIA Scheme)

- The purpose of this scheme is the same as the Advance License scheme i.e. to allow duty-free import of raw materials.

- However, unlike the AA, DFIA Scheme is a post-export scheme. It means that duty-free import is allowed only after the export is made.

- DFIA scheme is applicable to only those products which are covered under the Standard Input-Output Norms (SION).

- Another important feature of the DFIA Scheme is that the DFIA License is transferable. It does not come with actual user condition.

- Similar to Advance Authorisation Scheme, this scheme is implemented by the DGFT office. Below is the image covering all the important points related to DFIA license issuance.

Am I eligible for this scheme? – Yes, if your export product is covered under SION Norms and you yourself don’t want to import the raw materials duty-free, then you can take the DFIA License and sell it in the open market.

Duty Drawback Scheme (DBK Scheme)

- It is a refund of the duties given by the Govt. This scheme is implemented & monitored by the Department of Revenue [Customs Department].

- In the DBK scheme, duties of customs & central excise that are chargeable on imported and indigenous materials used in the manufacture of exported goods are refunded back.

- The rate of duty drawback for each product is different. You can find the entire Duty Drawback schedule here. [Subject to changes from time to time as per latest notification]

- Unlike the other schemes, Duty Drawback is directly credited into the Bank account of the exporter within 2 months from the shipment date.

- If you are availing the benefit of a GST refund, then you must opt for a lower rate of the Duty Drawback.

- DBK can be clubbed with any other export promotion scheme, but it cannot be clubbed with the Advance Authorisation scheme or DFIA Scheme.

Am I eligible for this scheme? – Yes, if your export product is covered under the Duty Drawback Schedule then you are eligible for it. You need to register your bank account and other details with the Customs department prior to your shipment.

Scheme for Rebate on State and Central Taxes and Levies (RoSCTL Scheme)

- The old RoSL scheme was replaced by the new RoSCTL Scheme from 07.03.2019.

- RoSCTL scheme is only applicable to the Apparels & made-up Industry covering Chapters 61, 62 & 63 of ITC (HS).

- It gives a refund of State and Central Taxes and Levies such as VAT on transportation fuel, Captive Power, Mandi Tax, Electricity Duty. Etc.

- It is implemented by the Directorate General of Foreign Trade (DGFT) and rewards are given in the form of MEIS like duty credit scrips.

- The RoSCTL scheme will be soon merged with the new RoDTEP Scheme for all sectors.

Am I eligible for this scheme? – Yes, if your export product is of the Apparels & made-up Industry coming under Chapters 61, 62 & 63 of ITC (HS), then you can claim benefits under the RoSCTL scheme for shipments after 07.03.2019. An application has to be made electronically to the jurisdictional DGFT office.

Export Promotion Capital Goods Scheme (EPCG Scheme)

- The objective of the EPCG Scheme is to facilitate the import of capital goods/machinery for producing quality goods and services and enhance India’s manufacturing competitiveness.

- Under the EPCG Scheme, Manufacturer exporter or a merchant exporter tied with a supporting manufacturer can import capital goods/machinery required for pre-production, production & post-production of export goods at 0% duty.

- Application to get an EPCG License must be made to the jurisdictional DGFT office.

- The Service exporters earning in foreign currencies are also eligible to apply for an EPCG License. Various service exporters can take the benefit of the EPCG scheme to reduce capital costs. Service Exporters like Hotels, Travel & Tour Operators, Taxi Operators, Logistics Companies, Construction Companies can utilize the EPCG Scheme by importing capital goods/equipment at 0% duty.

- EPCG scheme comes with an export obligation. The obligation is to export goods/services worth 6 times the duty saved value in a period of 6 years from the License issue date.

Watch this short introductory video on the EPCG Scheme; which explains the complex concept of EPCG in an easy to understand manner. It Explains What is EPCG Scheme and its application process; details about Export obligation & Redemption of EPCG License; entire summary and step by step procedures involved in the EPCG scheme.

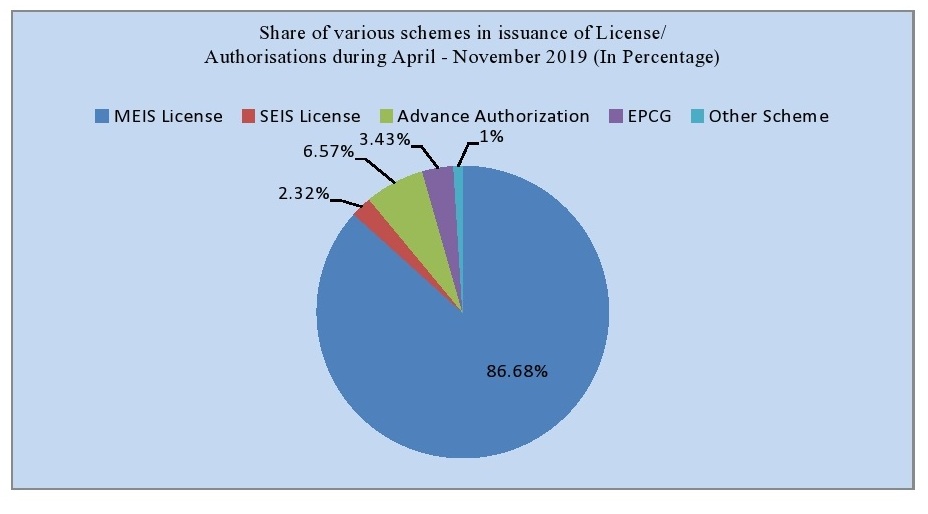

Am I eligible for this scheme? – Yes, if you want to upgrade your manufacturing process by importing the latest machinery, then you can take the benefit of the EPCG Scheme and import it with zero customs duty. This scheme is monitored by the DGFT until the EPCG License holder completes his/her export obligation. Non-compliance can lead to penalties along with duties+interest. EPCG scheme is a little complex, so you need to read all the terms & conditions before applying. Pie Chart below shows the percentage share of various schemes in issuance of MEIS/SEIS License and import authorisations.

[To know more about the EPCG License procedure & documents required for EPCG Scheme, you may refer our article here – EPCG Scheme]

EOU/EHTP/STP/BTP Schemes

- If you are a 100% exporting company, then you have an option to register yourself under the EOU Scheme [Export-oriented Units]

- The EOU scheme was introduced in 1981, with an aim to increase exports from India.

- The EOU scheme aims to provide a favorable ecosystem to the companies indulging in 100% exports by giving them certain waivers and concessions in compliance and taxation matters, thereby making it easier for them to conduct business.

- The major benefits of the EOU Scheme are – No Import duties while procuring raw materials or capital goods, faster custom clearance facilities, it can be set up anywhere in the country, unlike an SEZ unit.

- An application has to be made to the Board of approval to set up an EOU unit.

- The minimum investment in plants & machinery required is 1 Cr with exemptions to certain sectors.

- Around 2011-12, the EOU scheme became less prominent due to the removal of tax benefits given to it under the Income Tax Act.

Am I eligible for this scheme? – Yes, if you are 100% into exports and are ready to comply with the terms and conditions under the EOU Scheme, you can make an application and register your entity under the EOU scheme. One needs to weigh the pros and cons of the scheme thoroughly and then make a decision.

GST Refund for Exporters / LUT Bond facility / 0.1% GST benefit for Merchant Exporters.

- Exporters are given a host of preferential facilities under the GST Act.

- They can make an export supply either “on payment of GST” or “without paying any GST” under the LUT bond facility.

- LUT Bond Facility – Exporters can export goods without paying any GST by obtaining a letter of undertaking/bond.

- IGST Refund – Exporters can export goods “on payment of GST” and claim the refund of the same from the Customs Department.

- 1% GST benefit for Merchant Exporters. – Merchant exporters/traders can obtain goods meant for export from the domestic supplier at a 0.1% concessional GST rate. This reduces the burden of GST & solves the working capital issues for merchant exporters to a great extent.

- Every exporter can take the above GST benefits.

Transport and Marketing Assistance Scheme (TMA Scheme)

- This scheme is introduced only for the agricultural export products and it came into effect from 01.03.2019.

- Under the TMA Scheme, freight cost up to a certain amount is reimbursed by the Govt. to make Indian agricultural products competitive in the global market.

- The TMA scheme is eligible for all the export products covered under chapters 1 to 24 of the ITC HS Code, including marine and plantation products. However, some specific products falling under Chapter 1 to 24 would not be covered under the Scheme for assistance

- Assistance under the TMA scheme will be provided in cash through a direct bank transfer (DBT) as a part of reimbursement of freight paid by the exporter.

- This scheme is implemented by the DGFT office.

Am I eligible for this scheme? – Yes, if your export product falls between Chapters 1 to 24 of ITC HS and is eligible, then you can claim the benefits under the TMA Scheme. Quarterly applications are to be made to the jurisdictional DGFT office. However, if the export is made on a FOB basis, and no freight is paid by the exporter, then such shipments won’t be entitled to the scheme.

[To know more about the Eligibility criteria, amount of reimbursement given & Application procedure for TMA scheme, you may refer our article here – TMA Scheme]

Deemed Export Benefits

- The Objective of these benefits is to provide a level-playing field to the domestic manufacturers in certain specified situations, as may be decided by the Government from time to time.

- Following supplies are considered as Deemed Exports – (a) Supply of goods against Advance Authorisation / Advance Authorisation for annual requirement /DFIA; (b) Supply of goods to EOU / STP / EHTP /BTP Units; (c) Supply of capital goods against EPCG License.

- Deemed Export supplies are entitled to get any/or all of the following benefits – (a) Advance Authorisation/DFIA; (b) Deemed Export Duty Drawback; (c) Refund of terminal excise duty.

- Deemed Export benefits are implemented by the DGFT office.

Am I eligible for this scheme? – Yes, if your supply falls under the Deemed Export category, then as per chapter 7 of the Foreign Trade Policy (2015-20), you are eligible for the above-deemed export benefits.

Star Export House / Status Holder Certificate

-

- This is not a financial incentive scheme, but a kind of recognition/certification given by the Govt. of India to eligible exporters.

- Status holders are regarded as business leaders who have successfully contributed to India’s foreign trade.

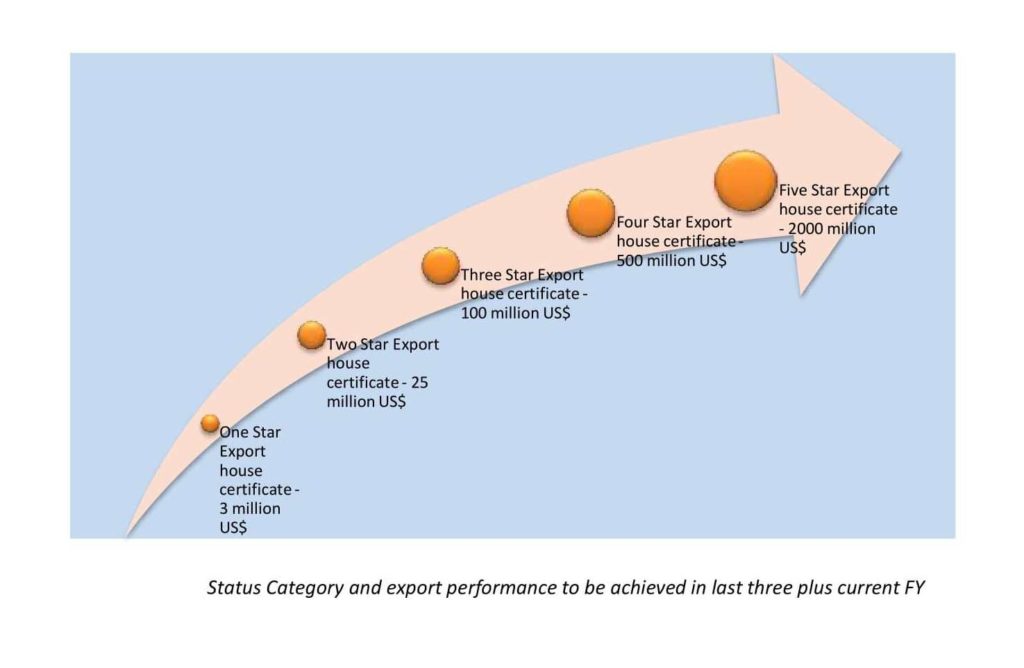

- Exporters are given the status of one star export house, two star export house, three star export house, four star export house & five star export house on achieving certain export turnover/performance.

- For Example, to get one star export house status, export turnover to be achieved in current plus previous three financial years (total four years collectively) is USD 3 million. Image given provide the status category & export performance which needs to be maintained in last three and current financial year.

- Star export house holders / Status holders are eligible for certain privileges like faster customs clearances, exemption from compulsory negotiation of documents through banks, exemption from furnishing bank guarantee required for various export promotion schemes, it also helps to get GR Waiver, preference in the payment of Import duties., etc among a lot of other benefits.

- An application to get the star export house category for your company has to be made to the jurisdictional DGFT office.

Am I eligible for this scheme? – Yes, if your export performance makes you eligible to get a Status Holder certificate, then you must apply and get the VIP exporter status for your business. Manufacturer exporters having MSME status are required to have an export performance of only USD 1.5 million in order to get one star export house status. This facility is known as double-weightage.

[To know more about the Eligibility criteria, double weightage facility for MSME’s, and the procedure to apply, you may refer our article here – Star Export House Certification]

Market Access Initiative (MAI Scheme)

- The new Market Access Initiative (MAI Scheme) was launched on 16th February 2018.

- The objective of this scheme is to play a catalytic role in promoting exports from India by exploring new markets and supporting all the export promotion activities in the new markets.

- The scope of the scheme is to provide financial support to eligible agencies for undertaking market access initiatives like direct/indirect marketing, market research, promotion & branding in new markets, and taking care of statutory compliance costs in the importing country.

- The eligible agencies include all the Export Promotion Councils, Commodity boards, registered trade promotion organizations, recognized associations, individual exporters (only where specified), national institutions like IIT’s, IIM’s, etc.

So How is the MAI scheme beneficial to Individual Exporters? – It is beneficial to Individual exporters in two areas: Individual exporters need to get in touch with their respective EPC to claim these benefits.

- Reimbursement of Airfare for International Events – Maximum of Rs. 70,000/- (Individual ceiling) (Rs.1,00,000/- for LAC countries). However, it comes with a condition that the exporter must have a turnover in preceding FY below 30 Cr and he should be a member of EPC for at least one year in order to apply for this benefit.

- Statutory compliances in the buyer Country – Maximum ceiling of Rs. 50 Lakh per annum per exporter on a 50-50% sharing basis. Statutory compliance includes Registration charges paid in the importing country in case of pharmaceuticals, biotechnology, chemicals/ agrochemicals, agricultural/ animal/marine products, food products, etc.

Market Development Assistance (MDA) Scheme

- This is an old scheme that was merged into the new Market Access Initiative (MAI Scheme), 2018.

- The new MAI scheme covers the scope of both the erstwhile Market Access Initiative (MAI Scheme) & Market Development Assistance (MDA Scheme).

Towns of Export Excellence (TEE)

- Towns exporting goods worth more than Rs. 750 Cr. And having high export potential are notified as Towns of export excellence (TEE).

- Financial assistance is provided to recognized associations in those towns as per the guidelines covered under the Market Access Initiative (MAI Scheme).

- As per Appendix 1B, there are a total of 37 towns of export excellence across the country.

- There is no direct benefit to Individual exporters under this scheme.

Interest Equalization scheme (IES)

- IES which is also known as an Interest subvention scheme was introduced in April 2015, to provide pre and post-shipment export credit to exporters in rupees.

- The Scheme provides 5% Interest support to all manufacturers in the MSME Sector and 3% support to all exporters (including Merchant exporters and largescale industries) in respect of only the identified 416 tariff lines.

- This scheme is implemented and governed by the RBI & respective Banks.

- Banks pass on the benefit of reduced interest directly to the exporters and then claim a reimbursement from the RBI.

Am I eligible for this scheme? – Yes, you can be eligible if your export product falls under the stipulated 416 tariff lines. Get in touch with your bank for more details.

NIRVIK Scheme

- The Export Credit Guarantee Corporation of India (ECGC) has introduced the NIRVIK Scheme which provides higher insurance cover, reduced premium for small exporters, and a simplified claim settlement process.

- It is primarily an insurance cover guarantee scheme that provides a cover of up to 90% of principal and interest as against the current credit guarantee of only up to 60% loss. The cover will include both the pre and post-shipment export credit.

- This scheme will ensure that the foreign and rupee credit interest rates will stay below 4% & 8% respectively.

- This scheme is implemented by the Export Credit Guarantee Corporation of India (ECGC Ltd); which is wholly owned by the Ministry of Commerce and Industry.

Am I eligible for this scheme? – Yes, all the exporters are eligible for this scheme.

Afleo Consultants is India’s No. 1 Export Incentive Consultant. We study your entire business process and guide you for all the eligible export benefits in India that your Company can claim. Our only motto is to get maximum export incentives for our clients within the policy framework.

We would appreciate your comments and views on the various export incentive schemes in India.