What is a PAN card and Aadhaar card?

Permanent Account Number (PAN) consists of 10 unique character code which links all the taxable transaction data in a single source, which makes it convenient for the Government to keep track. A PAN card is mandatory to file Income Tax returns in India. Everyone residing in India that pays taxes, including foreigners, are expected to have one.

An Aadhar card contains 12-digit unique identification number which serves as a proof of identity and address, It is Issued by the Unique Identification Authority of India. It is an initiative by the Indian Government with a purpose of single identification document for every Indian. The Aadhaar card consists of an individual’s demographic and biometric information.

Why Link Aadhaar to PAN?

According to the recent update by the Central board of direct tax (CBDT), the PAN Aadhar link deadline has been extended to 31st March 2019. Any individual who fails or is unable to link Aadhar to PAN card will face one major problem that is,

Let’s suppose your action to link Aadhar to PAN card is still on hold and wants to file income tax return. The filing of income tax return will not process unless your Aadhar PAN link process is complete.

Exempted category of people for Aadhar PAN link.

The Central Board of Direct Tax (CBDT) had mentioned the exempted individual for linking Aadhaar with PAN card.

- Those who come under the category of NRI (Non-Resident Indians) as per the Income Tax Act.

- Not an Indian citizen.

- A super senior citizen (80 years old or more) during the tax year.

- The resident of the states of Jammu and Kashmir, Meghalaya and Assam.

If someone does not fall under any of the above categories then it is mandatory for them to link Aadhaar to PAN.

How to link Aadhaar with PAN card (Methods and Process).

The Government of India had enabled the various method to link Aadhar to PAN card for the sake of convenience. The first method is by visiting the official e-filing website of the Income Tax Department, Second is an easy SMS-based process, the Third one is by filling up an offline form manually.

Method 1.

The process of linking Aadhaar with PAN (online).

Online process of linking Aadhar with PAN can be done by using income tax e-filing portal. There are two ways of doing it online via income tax portal.

a.Without logging in to your account.

This process consists of only 2 steps. This method consumes the least time and it is the easiest among all of them.

- First, go to “www.incometaxindiaefiling.gov.in” and click on the "link Aadhaar" in the quick link option on the left side.

- The next step (Final Step) is to fill up your PAN, Aadhaar no. and enter the name as exactly specified on your Aadhaar card (avoid any mistakes) and click on "Link Aadhaar”. After it is verified by “UIDAI” which is the government website for Aadhaar, the Aadhar PAN link will be confirmed.

Online form for linking Aadhaar and PAN without logging into your account.

A pop-up will appear after the process to link PAN with Aadhar is successful

b. Linking Aadhaar with PAN by Logging into your account.

There are certain Pros and Con’s for using this method.

Pros: Making an account on this site will give you access to other services provided by that site.

Cons: It’s the longest method which consists of 6 step and might take some extra time.

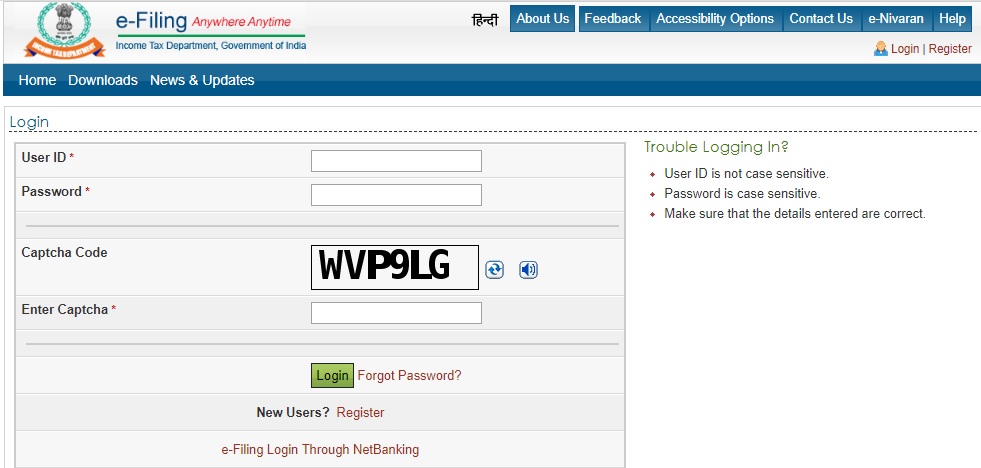

The First step is to register yourself at the income tax e filing portal, https://incometaxindiaefiling.gov.in/

The Second step is to Log into the e-Filing portal of the Income Tax Department by entering your credential.

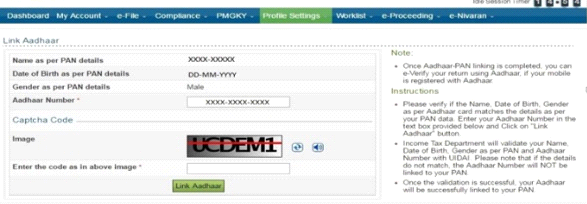

Third Step. After logging in, a pop-up window will appear which will prompt you to link your PAN card with Aadhaar card. If you don’t see the popup, go to the "Profile Setting" tab on the top blue bar and click on ‘Link Aadhaar’.

Fourth Step, The data about the name, gender and date of birth will be mentioned already as per the details filled during the time of registration on the e-Filing portal. Verify the details on the screen with your Aadhaar card.

Fifth Step, If the details matches, enter your Aadhaar number and then fill in the captcha code and click on the “Link now” button. (make sure the Aadhaar number and Captcha is entered as it is.

Sixth Step (Final Step), A message will pop-up on your screen informing you that your process of PAN Aadhar link has been successful.

Method 2.

Steps through which one can Link Aadhaar to PAN by using SMS.

If someone doesn’t have access to the internet, the CBDT has provided the facility by which one can link Aadhaar to PAN via SMS.

To link PAN with Aadhar via SMS, follow these steps.

First Step.

Type the message in the following format (make sure to leave the space in between as shown)

UIDPAN<Space><12 Digit Aadhaar no.><Space><10 Digit PAN no.>

Second Step.

Send the above message to either 56161 or 567678 from your registered mobile number.

Take an example:-

Your Aadhaar number is 667654321772 and the PAN number is ABCTE1244U, you have to type "UIDPAN 667654321772 ABCTE1244U" and send the message to either 567678 or 56161

After the process is done, you will get a confirmation message.

If your aadhaar and pan is already linked, u will get a message as mentioned below:-

“Aadhaar {“Aadhaar no.”} is already associated with PAN {“PAN no.”} in ITD Database. Thank you for using our Service”

Note:- SMS charges will be levied as per your mobile operator.

Method 3.

Filling up a form (Manual Method).

CBDT has provided an option for linking Aadhaar with PAN card manually in order to ease the problems of a person being unable to link Aadhaar and PAN through other methods.

You have to visit the service center of PAN service provider which is NSDL or UTIITSL and will be required to fill in the form 'Annexure-I'.

One has to carry original PAN and Aadhaar card along with filled “Annexure 1” to complete the offline process of linking of PAN and Aadhaar card.

Unlike online and SMS service, this service is not free of charge. An individual has to pay a prescribed fee. If there is any mismatch of information make sure you correct it before following the steps for linking Aadhar to PAN. An additional fee will be charged for every correction made in the PAN or Aadhaar details.

What’s the Bottom Line?

As mentioned about the major benefit which can be acquired by linking Aadhaar and PAN card, so it is advisable to link Aadhar to PAN card as soon as possible. All the processes mentioned above are very easy to do and any individual can do it from home using the internet or via SMS.

I hope this article helped you out and cleared all your queries.

If you have any query regarding any business registration work like Trademark registration, FSSAI, Incorporating a company, ITR filings, etc. please fill up the form given below as we provide free of cost consultation.

![New Foreign Trade Policy [FTP] 2023](https://afleo.com/wp-content/uploads/2023/04/New-Foreign-Trade-Policy-FTP-2023-Important-Highlights-315x242.jpg)