Having a small business and planning to make it bigger? Now you can make your business bigger and can make large profit from it just by creating your store/Business online in India, without shifting your business location or spending money. It is simple and effortless if you follow the right path. So, If you think the Idea is fascinating, try going online and sell your products and make your business visible nationwide.

As you can see, India is moving towards digital era and also advancing in technological way. There is the swift speed of growth in the digital sector which has increased the number of people buying most of the products online. According to BCG report, the number of India's online shoppers has crossed the 90-million mark in last year i.e. in 2017, a growth of over eight times has been experienced as compared to 2013, when the online shopping began- in which small towns and rural areas also got taste of the digital era.

Paytm, most trusted mobile e-commerce platform, has 80 million customers with a wide reach, servicing 39,000 pin codes across India. Paytm provides a great deal for the sellers to open up their business online on official page of Paytm Mall by listing them on top without any extra charge. Now suppose you have a business and you are already selling products on your outlet or shop in your locality, it is visible to only limited people around your locality and when your products are listed on the Website or App of Paytm, your products can be seen by millions of Paytm users. Your local business can become nationwide. Your online presence will be 24/7. Paytm has automated order and payment processing system and sales can be made at any time, and customers can buy when it suits them. It also offers Experts team assigned only for sellers, which will guide you throughout the process. They keep a track of your business and will help you whenever you are facing any problem while selling on Paytm.

Why should you become a Paytm Seller?

Paytm provides dual platform i.e. Website & Application to increase your visibility and sale of your products and to reach most of the people across India. Paytm already has 100K+ satisfied merchants and are selling their respective products successfully. By becoming a Seller on Paytm, the merchant doesn’t need to worry about the maintaining or marketing an ecommerce website instead of this you can rather focus on fulfilling customer orders quickly.

Paytm has easy and intuitive Paytm seller dashboard that simplifies all the day to day activities in sorted manner. Seller has to simply manage storefront, while Paytm Seller support takes care of the rest. They also have well simplified catalog upload to make seller’s usual tasks quicker and efficient and provide all aspects of inventory management at your fingertips through Paytm seller app. It also helps you in promotion and customizing deals and offers to attract customers to build trust and drive sales.

Before moving to Seller Registration Process, let us know the story of Mrs. Aishwarya Pandey, who began her journey, few years back on Paytm. She is still selling Indian wear & western wear both and earning great profit because of Paytm. She faced a lot of issues and her business got disturbed due to marriage, as she had to shift from one place to another. But Paytm helped her during such period and gave her business visibility, publicity and a platform to keep continuing her business without any hassle. Her business increased and she was getting 5-6 orders daily. Also, during festivals or sales(exhibitions) her business gets boosted to 20-25 orders per day. As she mentioned in her video by Paytm, “Women have to face a lot of problems as compared to men, they have to face different kinds of challenges like managing Married Life & during pregnancy it becomes difficult to manage business and family both together. In such situation, Paytm helped me to maintain and increase my Business”.

In the same manner, it becomes easier for anybody to start and increase their business as Paytm Seller. Also, one is sure of business expansion, publicity and visibility of one’s business nationwide as Paytm promotes your products all over social media and other various sources. Paytm Seller Support will help you incase if you are facing any issues while selling products on Paytm or Paytm Mall. Based on everything that you know till here, it is worth giving a shot to sell on Paytm!

How to sell on Paytm?

Anyone who has a unique product can sell it on Paytm or can become a Paytm seller. At first, we at Afleo help you to register your Company to kick start your business and also help you in TAX registration process. Company registration and Tax Registration are the basic requisites to register and start your business with Paytm Seller.

Steps to become a Paytm Seller:

Step 1: Register your Organization

- You can register your organization either into Sole Proprietorship or Private Limited Company or Partnership or LLP or any other suitable form of business. (Registration of PAN & TAN is included while registering for Private Limited Company or LLP).

Step 2: Tax Registration

- Once you have registered your Business entity or Company, GST Registration will be required to proceed further.

- GST registration will ensure a unique GSTIN.

- GSTIN is compulsory and will ensure further benefits.

Step 3: Create a Bank Account

- If you registered as a Company or want to get registered as a Seller on Paytm, it becomes compulsory to have a Bank Account in the name of Company or organization.

- To have a bank account is of vital importance to start your business as a Paytm Seller.

[Note: Those who have already registered their Company and created their Company’s Bank Account, can skip these steps and proceed to following Paytm Seller Registration Process]

Once you have registered your Company and created your Bank Account, you will now have to register on Paytm Seller Portal to start selling your products on Paytm. Registration process to become a Paytm seller is easy and can be initiated by searching Paytm Seller on search engine or can be accessed from this link:-https://seller.paytm.com/login. Anyone who wishes to sell their unique product on Paytm can sign up as a Paytm seller by providing the information about his/her business and products which he/she intends to sell via Paytm on Paytm Mall.

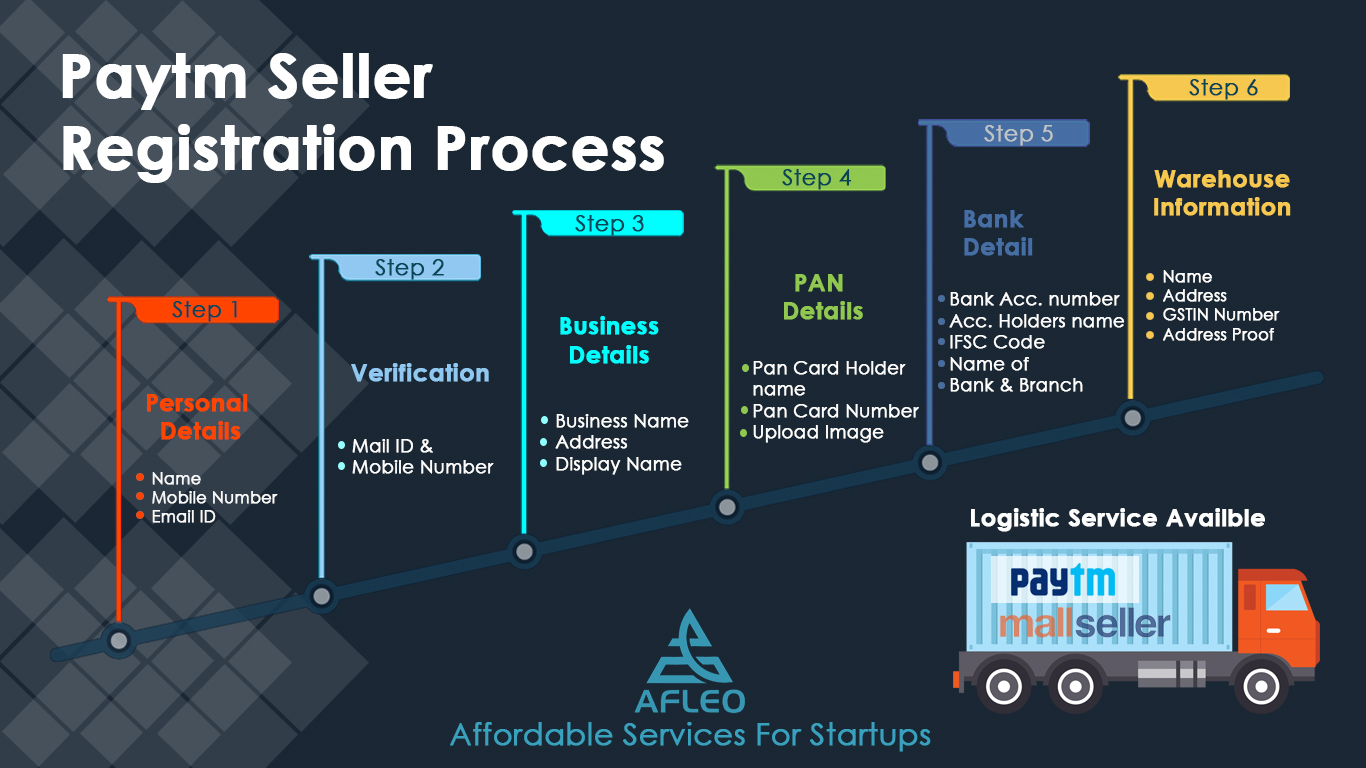

Paytm Seller Registration Process

The process of registration is done in following Steps.

Step 1: Open an Account on Paytm Seller

Visit Paytm Seller Login page or click here https://seller.paytm.com/login . You will be directed to Paytm Seller Registration page, here enter your name, mobile number and email address and submit it. Paytm would then send you an email for confirmation and later your Paytm Seller account will be created.

Step 2: Confirmation of Details

Check your mail box for the confirmation mail from Paytm. In that mail, there would be a confirmation link given, click on the link to confirm it and then you will be redirected to registration page directly. Where you have to verify your mobile number.

Steps 3: Business Information

In this step, you’re required to enter information that has been asked by Paytm for registration.

- Business Type: You will be given three options where you have to select one;

b) Private Limited Company/Public Limited Company

- Registered Business Name: It is your registered company’s name. This is the name under which a person or organization conducts a business and trades. Order invoice is also generated on this name.

- Display Name: Display name is the name which is visible to customer as "Sold by" name on Paytm Mall website.

- Registered Business Address &Pin code: A business address is an address on which your company name has been registered.

- Business Address Proof: You can submit any of following documents on your registered business name: GSTIN, Telephone/electricity bills, rent invoice, lease agreement, bank passbook and any other government document.

Step 4: PAN Details

As per government rules PAN is mandatory for financial transactions such as sale or purchase of assets, receiving taxable salary or professional fees.

- Enter PAN Card Holder Name & Number: PAN should be in the name of business (except in the case of sole proprietorship).

- Upload PAN Image: PAN image should be attested (signed and stamped) by authorized signatory of business.

Step 5: Bank Details

- Account Holder Name: Enter the account holder name by which you operate your company, firm, etc.

- Bank Account Number: Enter the account number of the account by which you operate operations of your company, firm, etc.

- Retype Account Number: Retype it

- IFSC Code: IFSC code is necessary, ask your bank if you don’t know.

- Bank & Branch : Enter the name of bank in which you hold an account.

Step 6: Warehouse Information

- Warehouse Name: Enter the Centre/Godown name for the ease of reference.

- Warehouse Address: Enter your Warehouse address with Pin code from where your shipments will be picked by the courier partner.

- GSTIN: In this field, you are required to entre GSTIN number. GSTIN is Goods and Service Tax-payer Identification Number, mentioned on the GST (Goods and Service Tax) registration certificate. As per the provision of sales tax, GSTIN is required for selling goods within India. You should have GSTIN for the state in which your warehouse is situated.

- Upload Warehouse Address Proof: You can submit any of following documents on your registered business name: GSTIN, Telephone/electricity bills, rent invoice, lease agreement, bank passbook and any other government document.

Step 7: Logistic Services

You get an option where you can select Paytm’s logistics Services. There will be a two options a)Yes & b)No. If you select “yes” you will avail all the benefits of Paytm Logistics Services. To know more about Paytm’s Logistic Services, click on this link: https://gobig.paytmmall.com/lmd-vs-nlmd/

After submitting required documents & entering all the details, you would reach to the end. Here you complete your process of registration. Now all you need to do is wait for approval by Paytm. You need to wait until Paytm responds you. Till then your account status will be pending.

[Note: Once you have established your shop and have started making profits there may be a chance where your brand logo or brand name might get copied or can be used by other person. This might affect your business. Paytm takes a declaration if trademark is not registered or applied for, by the seller. If someone else uses and has applied for trademark, the brand registration will be given to the other person. To avoid this it is preferable to register your products under a brandname or trademark to protect yourself from further legal entanglements.]

Paytm Seller Payout

Paytm Mall offers you the fastest and hassle free payment cycle. Once the order changes to ‘Delivered’ status on the Paytm Seller Dashboard, you will get a payment e-mail from them with an attached PDF invoice, which gives you the details of your order & your earnings. Paytm does all the payments on weekdays except for Saturday and Sundays.

Please note that the payout is made after deducting the sum of [marketplace commission + payment gateway charges + Logistics (LMD partner) + penalty (if any) + GST] from your selling price.

Payout Calculation

Fore more info, click on this Link: http://gobig.paytmmall.com/payouts/

Conclusion

Registering on Paytm Seller and selling your products online became very easy after easier access of internet. Just get the important documents that are required by Paytm. Make sure not to indulge in unfair practices to get yourself registered. Unfair practices can even lead you to get blacklisted by Paytm under Paytm Seller Policy. Now gear up, register yourself and start selling on Paytm Mall.

Afleo is a technology-driven business service platform and a leading solution provider for various registrations required for Startups to easily start & manage their business, at an affordable cost, across entire India and also deals in areas like GST Consultation, Intellectual Property Rights (IPR), Annual Compliance of Companies etc.

At Afleo, we love Startups & Young Entrepreneurs and hence in our articles, we provide solution for budding Entrepreneur’s, Startup’s and Businesses regarding all the essential and important Legal Services.

We hope this article was fruitful to you.

HAPPY TRADING!

We at Afleo are always there to help you. Please fill below form to get in touch.

Ищите в гугле